At the end of the global financial crisis in 2009 we saw a sugar rush within markets, specifically for a couple of quarters from March that year where economy-sensitive stocks performed very well. This is being mimicked somewhat today.

When the news from Pfizer landed, detailing success in its early stage vaccine trials, we began to see a rotation in market leadership. Where growth as a style had outperformed value by over 30% in 2020 (to the end of September1 the subsequent few days saw a rotation away from the previous market leaders (ie, those exposed to trends accelerated by Covid) and towards those that had been most impacted by the virus and subsequent containment measures. The question now is whether that broad value rotation will be sustained.

A temporary phenomenon

Our view is that this is not the case and the style rotation towards value and away from growth will be a temporary phenomenon. An economic recovery driven by a reopening of the economy on the back of mass vaccination will occur in 2021 and that will help shares that have fallen due to the impact of Covid – the “vaccine beneficiaries” for whom this represents the potential end to a temporary headwind. For example, travel and leisure-related industries will clearly benefit but, by extension, then so should the likes of Mastercard (as cross-border payments pick up) and other high-quality compounders that have been caught up in the turmoil.

More importantly, when we look at the medium-term prospects we continue to see an even more indebted world economy, exhibiting slow nominal GDP growth, experiencing fiscal drag as the bill for Covid has to be paid. The average company will, as it has post global financial crisis, struggle to compound earnings growth. This is reinforced by the structural changes in most industries as digitisation and decarbonisation disrupts traditional profit pools.

We have seen several of these rotations in the years since the global financial crisis and typically they have lasted two to three months. We continue to believe competitively-advantaged businesses with the ability to demonstrate compound growth will stand out above the market averages. These long-duration assets and durable growth companies that keep grinding higher have all the characteristics we look for in a business: sustainable returns driven by a sizeable moat, a high Porter’s Five Forces score, strong environmental, social and governance credentials and that sustainable competitive advantage.

We believe that bond yields are unlikely to return to pre-Covid levels and so the valuation of quality growth stocks should be sustained. On that basis we are already seeing the emergence of value in some names that fit our philosophy and as the value rally proceeds we will look for opportunities to improve the quality of our portfolios.

We anticipate seeing a broadening spread between the best companies – those that can sustainably deliver growth – and the average ones. This has been a clear trend over the past decade and one we expect should continue. Moreover, many of those trends that have been accelerated by Covid will continue, such as the rise of e-commerce, the growth of cloud computing, health care innovation and the expansion of capital-light, knowledge-driven businesses.

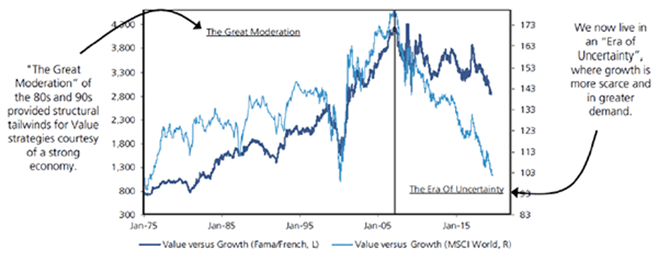

These powerful trends will continue to benefit companies across a range of regions and industries over a multi-year horizon. This is unlikely to change and these companies should, in our view, remain the medium- to long-term winners. Thus, we think this rush of recovery is unlikely to persist, and low inflation, low growth and low interest rates will be here to stay. This is shown in Figure 1, with faster growing companies standing out in the slower growing, post-global financial crisis environment – referred to as the “Era of Uncertainty”.

Figure 1: The 2008 crisis ushered in a structural shift in the style cycle

Source: International Energy Agency, June 2020.

A big fiscal deficit is of course potentially inflationary, but any inflation is unlikely to persist for two reasons: one is that there is a lot of spare capacity within the economy, as measured by unemployment and low industrial capacity utilisation; and secondly, any inflation will be accompanied by rising interest rates which will quickly dampen growth due to the cost of servicing such high levels of debt.

The power of research

Volatility will likely continue to be elevated in 2021, but it would be a mistake to make knee-jerk reactions to sudden strong moves in markets. Again, as investors we must maintain our strategic positions and focus on the longer term. We want risk within portfolios, but we want controlled risk.

At Columbia Threadneedle Investments, our research teams work collaboratively across all major asset classes, using big data and analytics such as machine learning and augmented intelligence to turn information into forward-looking insights that add real value to investment decisions, enabling consistent and replicable outcomes for our clients. Research Intensity is at the heart of our investment process.