Strategic asset allocation (SAA), the process of determining

a well-diversified long-term investment strategy, requires an

assessment of the potential returns from different financial

assets, as well as the potential risks to which these assets

and the final allocation may be subject. In this paper we

present the capital market assumptions (CMAs) that we at

Columbia Threadneedle use as central forecasts of risk and

return when conducting SAA analyses for our clients.

Investment strategy in 2021

How we forecast returns

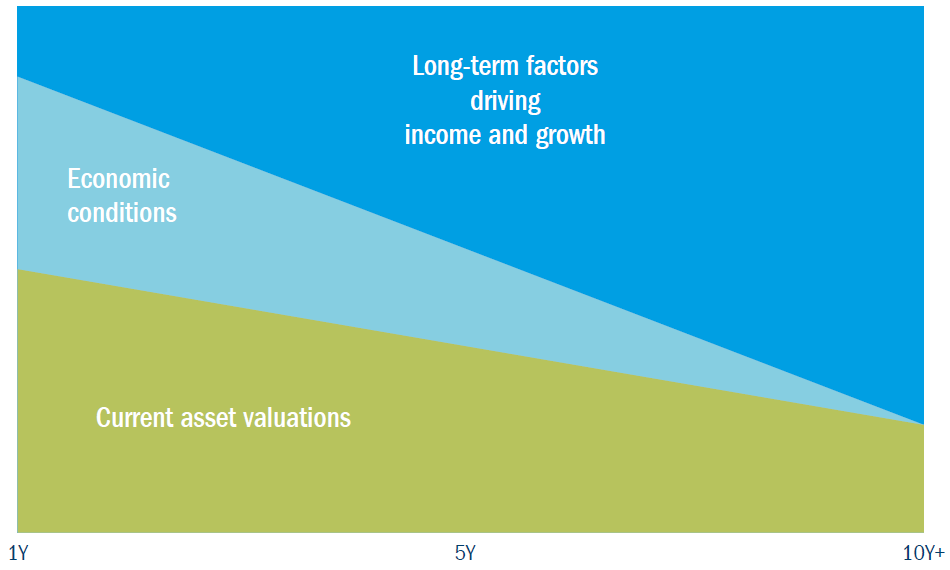

Source: Columbia Threadneedle Investments, March 2021. While changes in valuation dominate over short time

intervals, fundamental economic drivers come to the fore over longer horizons. For illustrative purposes only

- Term premium – The reward that investors require for long- rather than short-term lending, and hence taking on the risk that interest rates will rise.

- Inflation premium – Investors require a greater return for assets whose returns are not protected from increases in inflation, for example nominal bonds.

- Credit risk premium – The reward that investors demand for lending to non-sovereign institutions due to the risk of default.

- Equity risk premium – Investors in equity, real assets and commodities can suffer if the path of future economic growth is lower than expected and require a premium for bearing this risk.

- Emerging market premium – Less developed markets and countries can suffer dislocations and may be more subject to political risk.

- Illiquidity risk premium – Investors often require additional compensation for holding assets that can be less readily sold, particularly in a stressed market environment.

Cash and government bond returns

At the end of 2020, short-term interest rates are close to zero and market expectations are for them to rise only slowly in the coming years. Our analysis supports this view. Longer-term bonds typically offer higher yields than shorter-term bonds, a “term premium” as compensation for being exposed to inflation and changes in interest rates over the lending horizon.

However, we concur with analysis by US Federal Reserve economists2 that

this premium has reduced materially – and is even currently negative.

We expect reversion to higher levels over our forecast horizons, but that

short-term yields will stay low for a protracted period. The increase in yields will be slow, we believe, and will be to levels of 1.5%-2% rather than the yields that were observed in the past. We also expect investors to be rewarded for long-horizon lending, i.e., the term premium will become positive, but the level of the term premium will be below what has been observed historically. A summary of our forecasts for US returns over five- and 10-year time horizons is shown in Figure 2.

Component | 5Y forecast | 10Y forecast |

|---|---|---|

a. Cash | 0.1% | 0.8% |

b. Treasury bonds (7y duration) | 0.6% | 1.3% |

c. Term premium, (b-a) | 0.5% | 0.5% |

Equity returns

Component | 5Y forecast | 10Y forecast |

|---|---|---|

a. Cash | 0.1% | 0.8% |

b. Treasury bonds (7y duration) | 7.2% | 6.0% |

c. Term premium, (b-a) | 7.1% | 5.2% |

Putting our capital market assumptions to work in building SAA

- A spending target, e.g. 5% of the endowment is spent on projects each year;

- Real capital growth, sufficient to maintain the endowment’s spending

power in perpetuity.

Asset class | 5Y forecast (USD) | 10Y forecast (USD) |

|---|---|---|

US Cash | 0.1% | 0.8% |

US Treasuries | 0.6% | 1.3% |

Global Treasuries | 0.1% | 2.1% |

US TIPS | 1.7% | 2.3% |

US Corporates | 2.0% | 2.9% |

Global Corporates | 1.6% | 3.0% |

US High Yield | 4.7% | 4.1% |

Emerging market debt (USD) | 4.0% | 4.0% |

US Large Cap Equities | 7.2% | 6.0% |

US Small Cap Equities | 8.5% | 7.5% |

EAFE Equities | 7.4% | 5.9% |

Global Infrastructure Equities | 7.9% | 7.1% |

Emerging Market Equities | 9.2% | 8.8% |

Private Equity | 9.7% | 8.2% |

US Property | 7.9% | 8.8% |

Absolute return | 2.1% | 2.8% |

Commodities | 2.7% | 4.0% |

Source: Columbia Threadneedle Investments analysis, March 2021. See disclaimer for benchmark indices.

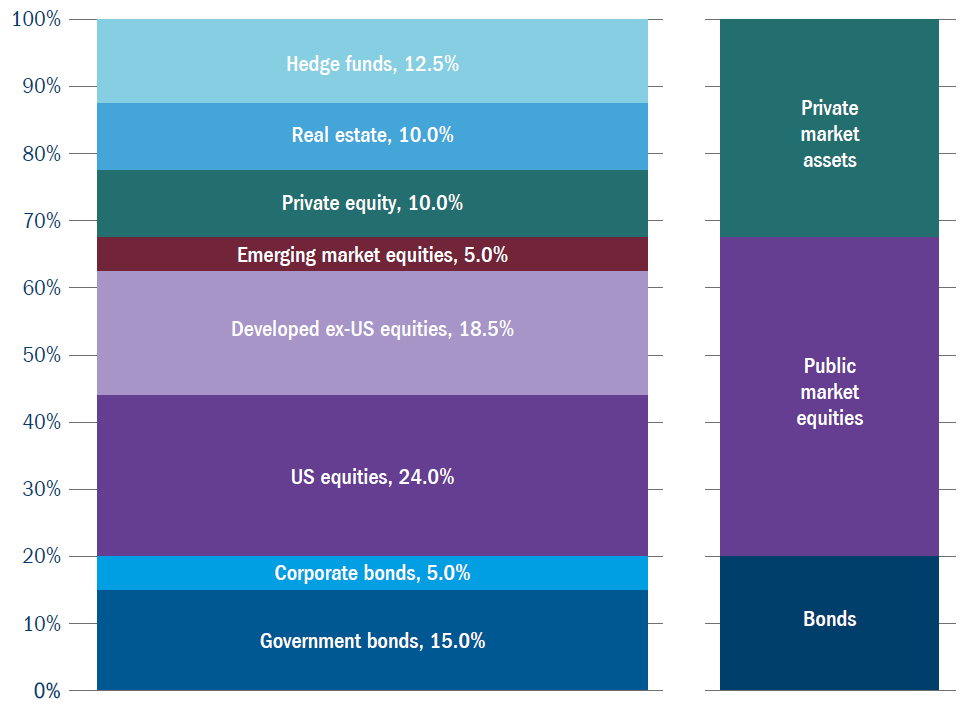

When building an investment strategy to deliver this objective, emphasis

could be placed on the income objective or on the return objective. Traditionally, institutions focused on real estate assets that delivered a high income with a secondary expectation of long-term real capital growth. In more recent decades, however, the focus has shifted towards total return³ delivered through a more diversified mix of assets. The spending target is no longer equated with assets’ income.

The long investment time horizon presents opportunities, giving the

institution a competitive advantage for investing in less liquid asset classes. Size may also provide a scale advantage when accessing alternative asset classes. Private equity, real estate and hedge funds are therefore included in the investment universe alongside more traditional assets when determining the SAA.

Source: Columbia Threadneedle Investments analysis, March 2021.

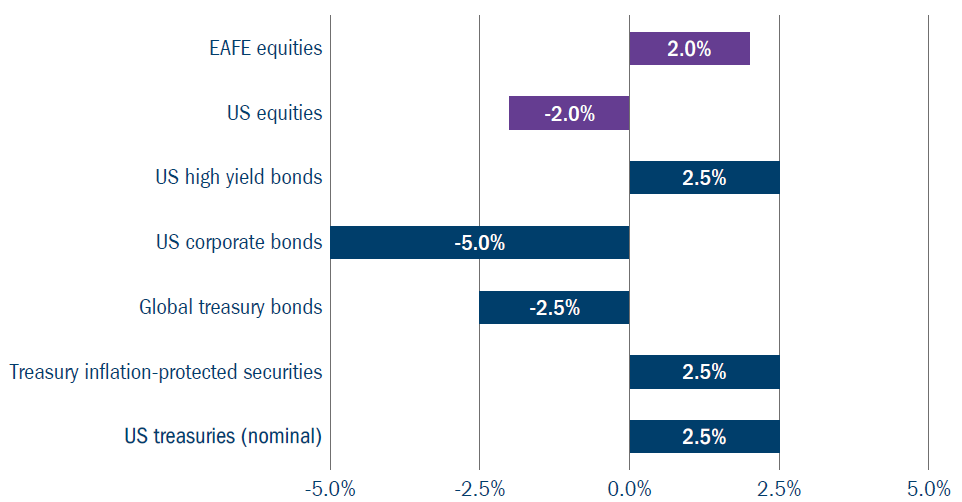

The tilts that arise from using our end of 2020 assumptions are shown in Figure 6. While US equities remain the largest equity allocation, this has been trimmed by 2% in favour of European, Australasian and Far East (EAFE) equities, reflecting the slightly higher return forecast for these regions.

Figure 6: Tilts based on end-2020 market conditions

Source: Columbia Threadneedle Investments analysis, March 2021. See disclaimer for benchmark indices.

Within bonds the main changes are:

- Overall duration is reduced, consistent with currently low yields and

the impact expected on returns of nominal bonds when yields begin to

increase; - In contrast, credit-spread duration is increased, reflecting our positive view of corporate bond returns relative to nominal bonds.

Additionally, there is a relative preference for inflation-linked over nominal bonds and for US over global bonds which leads to the final allocations shown in Figure 5.