UK Affordable Build-to-Rent

The Columbia Threadneedle UK Affordable Build to Rent Strategy has been designed to meet rental housing demand across the UK through the development and operation of purpose-built, affordable rental housing. The strategy targets a core return profile with the predominant driver of return being long term, inflation-aligned income, underpinned by the delivery of housing to one of the deepest occupier markets – low to middle income households.

- Target Total Return: 7.0%+ p.a.*

- Target Distribution Yield: 4.0%+ p.a.*

*Post stabilisation (triple net)

*These are targets and there can be no guarantee that they will be met.

Columbia Threadneedle Investment Real Estate Partners are the Investment Advisor to the CT UK Residential Real Estate FCP-RAIF.

Luxembourg RAIF – the fund is not a regulated investment vehicle and is not subject to the supervision of the Luxembourg supervisory commission of the financial sector (CSSF) or any other regulator.

Key Characteristics

Risk Statement

Our Strategy

We recognised that the supply imbalance in this market is such that the flow of capital and its deployment and ongoing management can deliver core market investment returns, underpinned by defensive and sustainable income streams, while creating positive impact by increasing housing supply and improving the quality and environmental credentials of available residents' homes.

Investment objectives:

• Facilitate institutional investment in new purpose built private rented housing, deriving a sustainable income stream

• Accelerate delivery of housing to address demand

• Innovate and improve the private rented sector through the pioneering of the Flexible Rent leasing model

Investment principles:

• Invest to build a diversified portfolio across core town and cities across the UK

• Deliver quality properties with professional management standards ensuring homes that are fit for purpose and promote longevity of income stream

• Deliver schemes quickly and efficiently in partnership with key stakeholders

• Deliver operationally efficient and environmentally resilient properties for the investor and occupier

• Integrate our buildings into the community

Why is this attractive to investors?

Diversification

Sustainable income

Inflation alignment

Measurable ESG impact

Market Opportunity

Affordable Build to Rent offers a compelling investment proposition, addressing deep demand for quality rental housing with a focus on preserving local affordability.

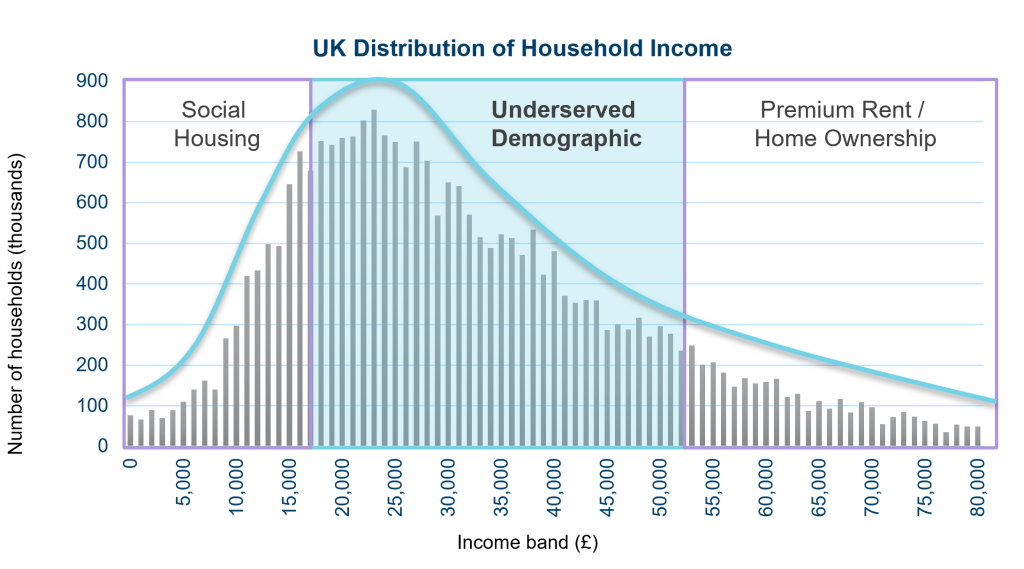

The private rented sector is flanked by government subsidised housing predominantly operated by Housing Associations on one side, and by private for sale housing on the other. Although the supply of mass-market Build-to-Rent is growing, historically investment has been more concentrated on the premium end of the market; developing high-end flats with lots of additional amenities. Furthermore, Build-to-Rent, particularly mass-market, still only represents a small proportion of the UK’s rental housing (c.2%), with a much lower market penetration than in Europe and North America where it can be up to 20% of available rental stock. This demonstrates considerable scope for growth and for private capital investment in Build-to-Rent to take a larger share of the market and fill the supply gap created by the increased sell-off of private rented homes from Buy-to-Let landlords.

Affordable Built-to-Rent is complementary to other forms of affordable and for sale housing, again demonstrating the opportunity for growth as additional investment seeks to fill the supply gap and cater to underserved demand to derive long-term, sustainable income stream. the sector specifically targets low to middle income working households, representing a broad and granular occupier market seeking quality and affordable rental options to meet their housing needs. It can accelerate the delivery of new schemes or regeneration of an area working alongside rather than competing with housing associations delivering social housing. Moreover, with ever increasing pressure on households, there is even more of a compelling opportunity for private capital to meet the need for affordable rental options and derive a sustainable and defensive investment return from an investment that can meet their financial, regulatory, and social objectives.

Targeting a deep underserved market of low to middle income working households across the UK

Source:

- Source: Office for National Statistics – Household disposable income and inequality in the UK: financial year ending 2020. UK disposable income defined by the ONS as income + benefits – taxes

All other charts / illustrations are Columbia Threadneedle Investments Real Estate Partners

ESG impact

Our environmental, social and governance (ESG) impact is our operational framework for defining, implementing and measuring our ESG actions and how they measure on the impact scale. Our ESG Impact Goals are the outcomes that we strive towards and measure against. As an Article 9 Fund under SFDR, these impact principles are incorporated alongside investment principles in acquiring and operating assets.

Underserved markets — deliver new supply of quality, professionally managed rental housing across the UK.

Sustainable living — promote sustainable development, operation and living.

Social value — generate positive environmental and social outcomes for all stakeholders.

The investment strategy brings real estate fundamentals together with addressing a deficit in housing provision for the largest proportion of UK households. Progressive ESG standards are applied to the design, development and operational phases of the Fund’s schemes in order to deliver Social Impact.

Partnership and innovation

The Fund is bringing together private capital and expertise with our exclusive development and operational partner — Home Group. The Fund’s partnership with Home Group provides a unique sourcing network specifically focused on delivering affordable Build-to-Rent and promoting the use of the FlexRent mechanism, with the Fund having access to schemes being delivered through Home Group’s relationships with local authorities and on their own balance sheet.

About Home Group

Partnering with Columbia Threadneedle Investments

– Mark Henderson, Chief Executive, Home Group