If it seems as if volatility is coming at you from all sides, we understand how you feel. As the coronavirus outbreak expands, global markets are experiencing unnerving losses. On top of that there are the social and healthcare ramifications of the pandemic and turmoil in the oil sector. It’s a recipe for a lot of uncertainty.

For the markets, what started as concerns over disruptions in manufacturing and supply has shifted to deep worry over a protracted economic shutdown. “There will be a serious hit to US growth,” says Anwiti Bahuguna, Senior Portfolio Manager and Head of Multi-Asset Strategy, North America. “If the outbreak disrupts demand for a prolonged period the impact will be significant.”

But while you can be sure our investment teams are keeping one eye on these fast-moving trends, the other is fixed firmly on the long term. “The current outbreak is novel,” says Gene Tannuzzo, Deputy Global Head of Fixed Income, “but our playbook for spikes in volatility like this remains pretty much the same.”

Just how temporary is temporary?

Amid this flood of sometimes conflicting information, you’re getting another constant message: that you should stay the course – that markets will eventually recover, as they have many times before. And we think that’s great advice. But essentially you are being asked to do nothing. To sit it out. And for a lot of us that can be hard, especially when we see account balances dropping and imagine retirement dreams slipping away.

We’re going to give you some good reasons to be patient and stay the course. But also, we’re going to recommend something you can do. And that is to take this opportunity to check in on your long-term goals and deepen your relationship with your financial advisor.

Been there, done that

Let’s take a step back. Chances are, the first time you met and set out a plan with your financial adviser, the markets weren’t in crisis. And if you started investing within the last 10 years, you’ve never had to deal with volatility and losses as dramatic as those we’re seeing now. But your advisor probably has, and if you’re investing for the long term, you may go through one or more of these full market cycles — from the top to bottom and back again — before you retire.

We encourage you to talk to your adviser about the effects of market cycles, how they factor into the long-term strategies he or she recommends and what it means for your particular portfolio. It might need a nip or tuck, but if your strategy was truly built for the long term, it’s probably in good shape to see you through short-term setbacks such as this one.

Cycles come and go, but the market marches on

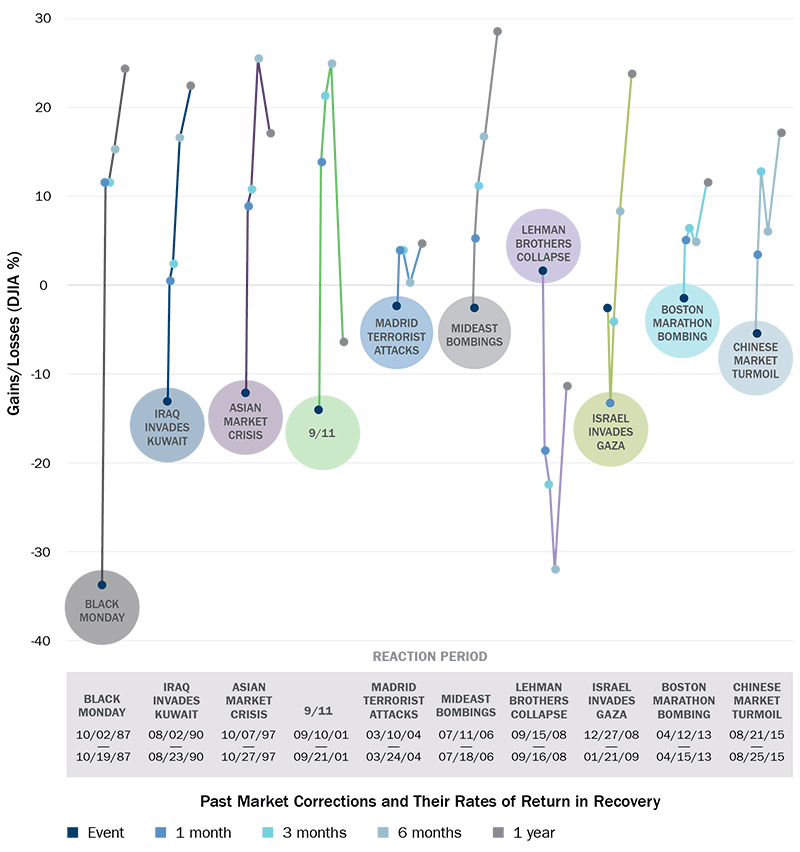

The bad news is that major market corrections are painful and costly. The good news is that, historically, the recoveries afterward have typically been strong and sustained (Figure 1).

Figure 1: Percentage changes in the Dow Jones Industrial Average

Source: Columbia Threadneedle Investments and Ned Davis Research, Inc., 02/2020. Copyright 2020 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/ The most widely used indicator of the overall condition of the stock market, the Dow Jones Industrial Average Index is a price-weighted average of 30 actively traded blue chip stocks as selected by the editors of the Wall Street Journal. It is not possible to invest in an index. Past performance does not guarantee future results.

Your adviser is your best sounding board and guide

When you’re tempted to make significant investment moves during volatile periods, having the outside perspective of an experienced financial advisor is critical. They can give you reasoned answers when you question your long-term strategy, explain how your portfolio is positioned for difficult markets and help you stay on track to meet your long-term goals – especially if you’ve never experienced the kind of deep market swings we’re seeing now.

Keep a healthy perspective

In the midst of the longest bull market in history, it was easy to feel confident about your investment strategy. Seismic drops like we’re going through now not only test that confidence, they can lead investors to make decisions based on fear and uncertainty. It’s a natural impulse to seek safety when it feels like the bottom is dropping out. But decisions based on panic around short-term disruptions have the potential to undo the benefits of years of long-term, committed investing.

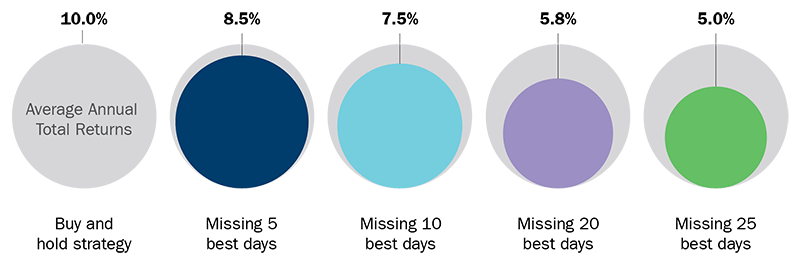

To have captured the best days, you had to be in it for the worst

Volatility can tempt you into trying to time the markets. Getting out is easy. Getting back in at the right time is nearly impossible. If you missed the best-performing days you would have given up a significant portion of the market’s long-term total return (Figure 2).

Figure 2: S&P 500 Index returns 29/12/1989 – 31/12/2019

Source: Columbia Threadneedle Investments and Bloomberg as of 12/31/19. The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization US stocks. It is not possible to invest in an index. Past performance does not guarantee future results.

Don't miss a beat

We expect markets will continue to be volatile for the near term, and that short-term risks and fluctuations may continue throughout the year.