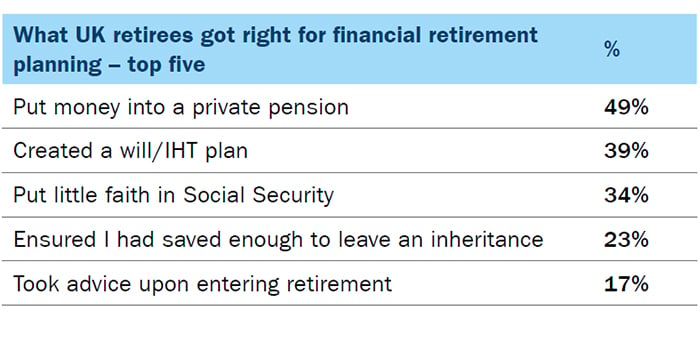

Learning from retirees – what they got right and what they got wrong

- 29% regretted not considering long-term care costs

- 18% regretted putting too much faith in the government (social security, healthcare)

- 17% regretted not having a private pension

- 15% regretted not saving enough to leave an inheritance

- 13% regretted not taking professional advice

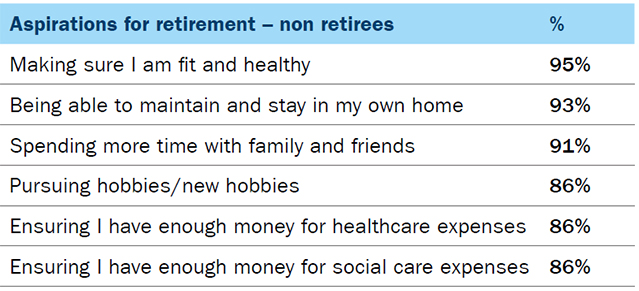

Young people have the opportunity to think more long-term about money

Ben Kelly, Senior Thematic Analyst, Responsible Investment at Columbia Threadneedle

Investments and behavioural economist said, “Regret can be a really dark place for investors. Many try to avoid it by avoiding making decisions with their money altogether. But doing nothing can lead to far greater regret later in life and this is what some older generations are dealing with today. Investing for the future can be a hard sell for young people as there is little instant gratification. How do you get younger people to understand the problems they will face in later life? The Covid-19 pandemic may have

led younger generations to start thinking about their financial future. This could be the right time to help them put a long-term strategy in place which in turn will help them make good financial decisions throughout their adult life.”