Japan’s companies are adopting more shareholder friendly policies. We explore the opportunities for investors and explain why we’re currently overweight Japanese equities across the CT Universal MAP portfolios.

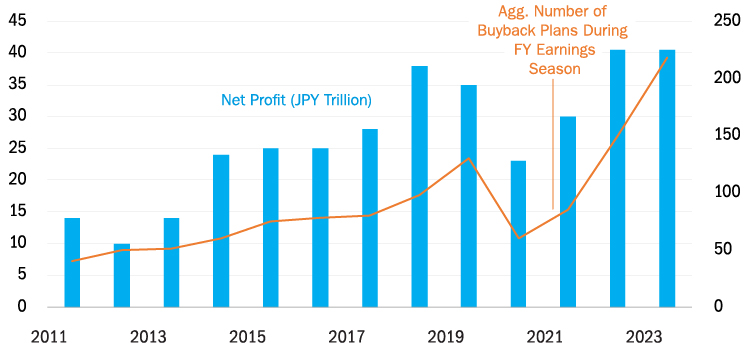

The chart shows that Japanese companies are enjoying good profitability, but, much more importantly, that these companies are rapidly increasing their use of buy-back plans as part of a shift to deliver greater returns to shareholders.

Japanese companies start to focus on shareholder value

TOPIX aggregate net income and share buyback announcements

There’s often been talk of Japanese companies adopting more shareholder friendly policies, but this time it is the law!

In April of this year, another policy move aimed at increasing Japanese corporate profitability was launched, the inelegantly named Action Plan for Substantiation of Corporate Governance Reform. Companies listed on the Tokyo Stock Exchange are required to disclose risk-taking plans and measures taken to achieve growth while keeping profitability in mind. More specifically, firms with a price-to-book (P/B) ratio below 1x will be flagged and requested to “properly identify” their cost and efficiency of capital.

Our global equity team have flagged that the magnitude of cash on some Japanese firms’ balance sheets provides clear opportunities to increase return on equity by around 5%. That means handing the zero-yield cash back to investors and even considering gearing up their balance sheets with borrowing at current low rates. This represents a very significant opportunity for companies to boost to shareholder returns and one that can be independently delivered by the management and which is not reliant on any external market or economic factors.

Valuations still look attractive in the region especially with the structural changes that are occurring within Japanese corporates. Increased research & development and investment should translate to productivity gains and buybacks and dividend payments have been increased, which should mean better shareholder returns. Central bank monetary policy remains incredibly loose. We are currently overweight Japanese equities.