Doing business with us

Adviser Support

ISA Centre

In July 2014, ISAs were reformed into a simpler product. They now allow investors to save in cash, stocks and shares or a combination of the two in any proportion to suit the investor.

- 2021/2022 ISA allowance: £20,000

- 2022/2023 ISA allowance: £20,000

Our ISA

Our ISA only offers investors access to the Stocks and shares ISA.

Choice

Our comprehensive ISA range has something for everyone whether they want income or growth or a mixture of both. See our full Investment Range.

Looking for an ISA transfer option?

If any of your current ISAs no longer meet your needs, you may wish to consider transferring them to us.

2022/2023 Transfer Form, as at 6 April 2022

For further information on our fund range or ISA options please refer to Key Investor Information Document or contact our Client Services Team on 0800 953 0134 Monday to Friday 8am – 6pm (Calls may be recorded).

Edition six – The Defined Contribution Future Book

The 2020 edition of the DC Future Book, published by the Pensions Policy Institute in association with Columbia Threadneedle Investments, has found that UK Defined Contribution (DC) pension assets are growing, despite a challenging start to the year due to the Covid-19 pandemic.

As an established annual compendium of statistics, the DC Future Book provides an insight into the state of play of DC workplace pensions along with its likely direction of travel. Since its inaugural publication in 2015, the publication has been tracking DC membership rates, contribution levels, pot sizes, auto-enrolment milestones, investment allocation trends and much more.

The newly released data shows that in the 12 months to the end of July 2020:

- Aggregate DC assets have grown from £430 billion to £471 billion and the median DC pot size stands at £9,600.

- Aggregate combined employee and employer contribution rates have increased from 4.5% to 7%.

- 10.3 million employees had been auto enrolled by 1.7 million employers. This is nearly twice as many employees as those recorded in 2015 (5.4 million).

- The average proportion of actively managed assets has ranged between 76% – 89% for Stakeholder Pensions and Group Personal Pensions, and between 54% – 57% for Master Trusts.

Lauren Wilkinson, Senior Policy Researcher at the Pensions Policy Institute, said:

“This year’s edition of the DC Future Book shows a continuation of positive trends associated with Automatic Enrolment. A further 2 million employees have been automatically enrolled compared to the same time last year and another 159,000 re-enrolled, while average contribution rates have also increased. Trends in access to DC savings have also continued, with most pots fully withdrawn, but a greater amount of money invested in drawdown products than was either fully withdrawn or used to purchase annuities. It will be crucial over the next year, and over the longer-term, to monitor how these trends evolve in response to the current Covid-19 pandemic.”

Furthermore, the DC Future Book 2020 explores the responsible investment approaches available to DC pension schemes, including their suitability for different scheme types and sizes, with financial implications of Environmental, Social and Governance (ESG) factors becoming increasingly important considerations in pension schemes’ investment decisions. ESG issues have become more pressing, both in and of themselves, as well as a result of external pressures such as increased regulation and a broader societal focus.

Nick Ring, CEO, EMEA at Columbia Threadneedle Investments, commented:

“We have been proud sponsors of the DC Future Book since its inaugural publication. To say that much has happened over the last 12 months is an understatement. The global Covid-19 pandemic has been complex to understand and navigate and has come at considerable human and economic cost. Against this backdrop it is encouraging to see continued growth in UK DC pensions assets, but we are not out of the woods yet.

“While many investment markets have recovered, this is a time of great change in people’s behaviour, the way consumers interact with businesses and the nature of transactions. Over the next few years companies will have to endure an extremely testing economic environment that not all will survive. For DC pension scheme trustees, the challenge and opportunity lie in working with those asset managers that can uncover the pandemic’s long-term impacts and apply them to portfolios in order to manage risks and achieve sustainable long-term returns for their scheme members.”

According to Columbia Threadneedle, such analysis would not be complete without responsible investment or environmental, social and governance (ESG) research, not least due to the social issues the pandemic has propelled into the spotlight. There has been a 530% increase in issuance of specifically labelled “social bonds” year on year1 as governments, supranational entities and corporates rushed to raise funds aimed at alleviating the pandemic, including for health care support, education and job preservation.

“We have seen robust commitment from the investor community to invest in bonds that directly address the impacts of the pandemic and support affected communities. Allocating DC member assets to impact-oriented social bond strategies is one way for trustees to invest responsibly. As this year’s DC Future Book shows, there are many others, such as engaging with companies to drive change or excluding certain sectors or industries from portfolios. While integrating ESG considerations into investment strategies can be complex, all DC schemes regardless of size and set-up should be able to find a solution that best serves the long-term interests of their scheme members”, Ring concluded.

We hope that you find this year’s publication and its findings as insightful as we did.

Download reports

Other literature

Behavioural motivation guide

Download our behavioural motivation guide, which provides methods to identify, mirror and interact with your client based on their “promotion” or “prevention” motivation.

PAIF Explained

A Property Authorised Investment Fund (PAIF) is an open-ended investment company (OEIC), authorised by the Financial Conduct Authority, that specialises in holding property, and where taxation on the profits of its property investment business lies with its investors.

The PAIF regime was first introduced to the UK in 2008, and was received as a welcome addition to the UK fund landscape. However, in the wake of the economic downturn, initial take up was lower than expected, leading to further reforms to the regime being made in 2012. Since then the regime has proved increasingly popular, with a number of PAIFs subsequently being launched.

The principal attraction of the PAIF structure is that eligible investors within a PAIF can receive gross income from their investment. Eligible investors include tax-exempt investors – individuals investing through an Individual Savings Account (ISA) or Self-Invested Personal Pension (SIPP) – as well as tax exempt institutional investors such as pension funds.

Key requirements:

In order for a property fund to be PAIF compliant, it must adhere to the following:

- Operate Property Investment Business;

- Report income in three “streams”; and

- Not permit Body Corporates to hold more than 10% of Net Asset Value of the fund.

To qualify as a PAIF, Property Investment Business must be undertaken. This means carrying on a property rental business which generates income from land and/or to carry on a business consisting of owning shares in UK real estate investment trusts (REITs) and/or their foreign equivalents.

Typically, a property fund will derive its income from various sources, including rental income and interest. An authorised property unit trust will suffer 20% corporation tax on property rental income, distributing income onward to investors as a single “dividend” payment. As a result, the 20% tax paid cannot be reclaimed.

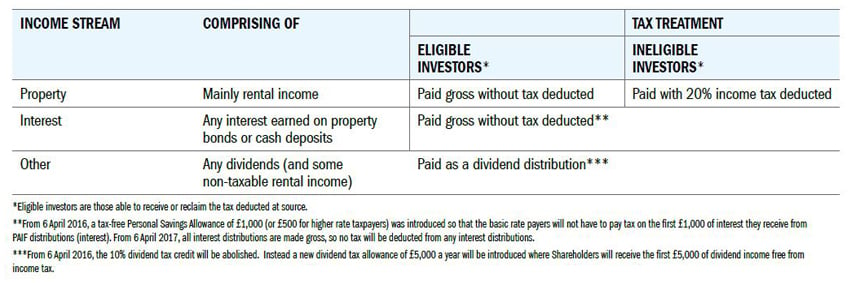

In contrast, a PAIF separates its distribution in to three different “streams” for UK tax purposes (reflected in the associated tax voucher):

- Property income;

- Interest income; and

- Other income (dividends)

Splitting the income payment in this way allows each stream to be treated differently for tax purposes. Since income is no longer subject to 20% tax within the fund, both property income and interest income can be paid gross to eligible investors.

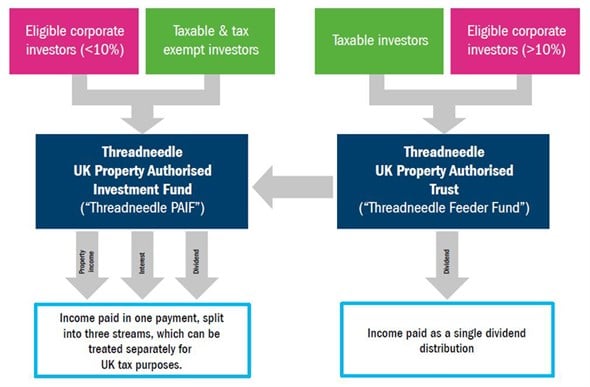

A feeder fund linked to a PAIF, whilst not subject to the same tax rules, can provide investors with an efficient means to obtain exposure to the performance of the PAIF. Feeder funds are often established for PAIFs because certain investors are either ineligible, or unable to invest in the PAIF. For example, HMRC rules prevent any Body Corporate from owning 10% or more of a PAIF directly, whilst many Platforms are still operationally unable to process streamed income payments for their clients.

Tax exempt investors, including individuals holding their investment in an ISA or in a SIPP, will benefit from the PAIF structure. This is because both property income and interest income can be paid gross of tax. All things being equal, tax exempt investors can expect to receive an uplift of 25% in investment income compared to an authorised property unit trust.

Higher and additional rate taxpayers who currently hold units in an authorised property unit trust outside of a tax wrapper such as an ISA or SIPP may benefit from holding units in the Feeder Fund rather than shares in the PAIF structure, from 6 April 2016, if their dividend income, including the dividend income from the Feeder Fund, received in a tax year is less than the £5,000 dividend allowance.

Columbia Threadneedle Investments plans to convert the Threadneedle UK Property Trust (the Trust) into the Threadneedle UK Property Authorised Investment Fund (the ‘Threadneedle PAIF’), a newly-formed Open-Ended Investment Company on 14 May 2016.