CT UK Social Bond Fund

Woven for social impact and long-term returns

A pioneer in social bond investing. We launched the UK’s first daily liquid social bond strategy in 2014, followed by European and US based strategies, and have been a leading advocate of the burgeoning green and social bond markets.

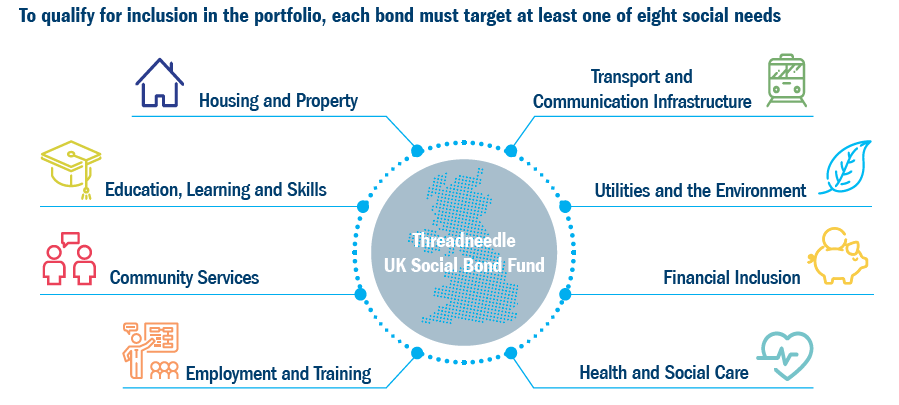

The CT UK Social Bond Fund unlocks the full potential of bonds to deliver both financial returns and positive social outcomes.

Ratings as at 30.09.2022

Overview

Strength in partnership

Consistent track record in social bond investing

Collaborative approach

Reasons to invest

Strength in partnership

Our proven experience in both fixed income credit and responsible investment is enhanced by our social partnership with Big Issue Group, social entrepreneurs and a leader and innovator in backing sustainable social businesses in the UK.

The Big Issue Group, brings its expertise and reputation by:

- Advising on our proprietary social classification methodology

- Challenging our social assessments via a quarterly Social Advisory Panel independent panel

- Producing an independent annual report

Consistent track record in social bond investing

Collaborative approach

Positive Inclusion, Evidence-based Analysis & Engagement

Eligible investments are ranked as high, medium or low intensity by our specialist Responsible Investment team, while our credit research analysts ensure investment ideas pass rigorous financial, ESG and liquidity tests for inclusion in the portfolio.

Insights

CT UK Social Bond Fund impact report 2023 - transport and communications infrastructure

UK Social Bond Fund impact report 2023 - Affordable housing and property

CT UK Social Bond Fund - Foreword 2023

Explore fund details

Filter insights on this page

Capabilities

Media type

Strength in partnership

Themes

Regions

Fund Manager

Tammie Tang a rejoint la société en 2012 en qualité de gérante de portfeuille investment grade. Elle est gérante principlale de divers portefeuilles de crédit britanniques, en ce compris le Threadneedle Pensions Corporate Bond Fund. Tammie est également fiduciaire désignée de la société pour le plan de pension à prestations définies de Threadneedle.

Précédemment, Tammie a occupé différents postes chez Pricewaterhouse Coopers à Sydney et JPMorgan à New York. Membre de L'Institute of Actuaries Australia, elle est titulaire d'un master en statistiques de L'Université de Nouvelle-Galles du Sud.

Important Information

Key risk

Past performance is not a guide to future returns and the fund may not achieve its investment objective. Your capital is at risk. The value of investments can fall as well as rise and investors might not get back the sum originally invested. The fund holds assets which could prove difficult to sell. The fund may have to lower the selling price, sell other investments or forego more appealing investment opportunities. Most bond and cash funds offer limited capital growth potential and an income that is not linked to inflation. Inflation is likely to affect the value of capital and income over time. Changes in interest rates are likely to affect the fund’s value. In general, as interest rates rise, the price of a fixed rate bond will fall, and vice versa. The investment policy of the fund allows it to invest in derivatives for the purposes of reducing risk or minimising the cost of transactions. The fund invests in securities whose value would be significantly affected if the issuer either refused to pay or was unable to pay or perceived to be unable to pay. The fund holds assets which could prove difficult to sell. The fund may have to lower the selling price, sell other investments or forego more appealing investment opportunities. Most bond and cash funds offer limited capital growth potential and an income that is not linked to inflation. Inflation is likely to affect the value of capital and income over time. Changes in interest rates are likely to affect the fund’s value. In general, as interest rates rise, the price of a fixed rate bond will fall, and vice versa. The investment policy of the fund allows it to invest in derivatives for the purposes of reducing risk or minimising the cost of transactions. Please read the Key Investor Information Document and the Fund Prospectus if considering investing.

Columbia Threadneedle Opportunity Funds (UK) ICVC is an open-ended investment company structured as an umbrella company, incorporated in England and Wales, authorised and regulated in the UK by the Financial Conduct Authority (FCA) as a Non-UCITS scheme. This material should not be considered as an offer, solicitation, advice or an investment recommendation. This communication is valid at the date of publication and may be subject to change without notice. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness. The current Prospectus, the Key Investor Information Document (KIID), latest annual or interim reports and the applicable terms & conditions are available from Columbia Threadneedle Investments at PO Box 10033, Chelmsford, Essex CM99 2AL, your financial advisor and/or on our website www.columbiathreadneedle.com. Issued by Threadneedle Investment Services Limited. Registered in England and Wales, Registered No. 3701768, Cannon Place, 78 Cannon Street London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.