Campaign

CT Global Focus Fund

Quality leads to consistent growth

The CT Global Focus Fund is a best ideas portfolio of the world’s high-quality companies. Following the approach of our successful SICAV strategy, this fund seeks out quality companies with sustainable competitive advantage that are able to continually grow their earnings above the market. Our extensive research network of equity investment professionals across geographies and sectors equips Fund Manager, David Dudding, with a uniquely broad and diversified investment opportunity set, crucial at a time when growth is scarce.

Overview

More opportunity - Global research capabilities drive differentiated stock holdings

Although a focused portfolio of typically 30-50 holdings, the fund has a more balanced and diversified opportunity set and no reliance on a particular sector or geography to drive performance. For example, exposure to faster growing emerging market economies and quality companies within areas such as financials.

More quality - A clear and differentiated quality approach focusing on competitive advantage

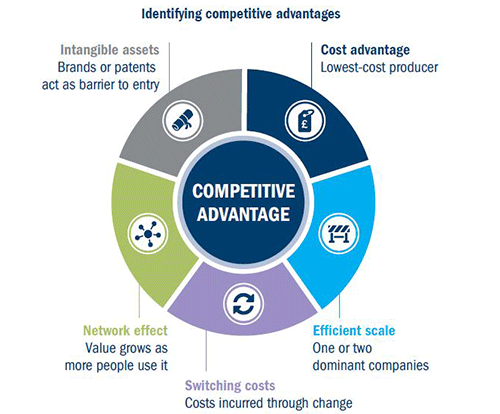

The team looks for multiple sources of competitive advantage in businesses that provide a wide economic moat, such as strong brand, low-cost production, network effect, efficient scale meaning only a few large players can operate, and switching costs that make changing a service or product expensive. The team believes these competitive advantages give businesses a strong position to withstand disruptive innovation.

More growth - Invests in companies sustainably growing faster than the market

The fund has a growth tilt with no style drift, which the team believes is especially important in a structurally lower-growth environment.

Key facts

Target benchmark

MSCI AC World

Comparator Benchmark

UK IA – Global

Fund Launch

April 2018

Typical number of holdings

30-50

Fund manager

David Dudding

Philosophy & approach

The team’s style is based on the search for high-quality stocks which have multi-source competitive advantages alongside robust business models, and therefore strong and sustainable long-term growth potential. The ability of quality companies to sustain high returns on capital and above-average growth is often underestimated, meaning that potential long-term winners trade at a discount to their intrinsic value.

- Competitive advantage manifests itself in a company’s ability to generate high returns on capital

- The market tends to assume that high returns mean-revert, causing quality companies to be undervalued with growth potential

- Identifying companies with a sustainable competitive advantage exploits this inefficiency

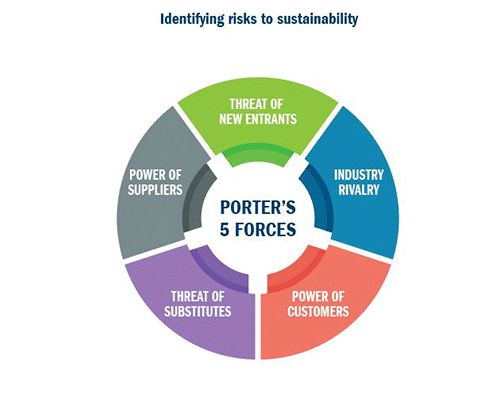

The team thoroughly analyse both company fundamentals and industry prospects, using a competitive advantage framework to identify economic moats, and apply Porter’s Five Forces to assess the sustainability of those competitive advantages.

Working with our equity research teams across the globe they then build a high conviction, best ideas portfolio of quality companies with strong growth potential.

With a ‘go anywhere’ approach, stock selection drives sector and regional weightings, and we believe our focus on businesses with strong fundamentals drives outperformance across a range of market conditions, with your clients success our priority.

Explore Fund

Insights

Market Monitor – 26 July 2024

Page turners – our summer reading list

In Credit Weekly Snapshot – July 2024

Objective

The Fund aims to achieve capital growth over the long term. It looks to outperform the MSCI ACWI Index over rolling 3-year periods, after the deduction of charges. The Fund is actively managed, and invests at least 75% of its assets in a concentrated portfolio of shares of companies worldwide. The Fund selects companies in which the fund manager has a high conviction that the current share price does not reflect the prospects for that business. These companies may be chosen from any economic sector or geographic region, with significant sector and share weightings taken at the fund manager’s discretion. There is no restriction on company size, however, investment tends to focus on larger companies, such as those included in the MSCI ACWI Index. The MSCI ACWI Index is regarded as providing an appropriate representation of the share performance of large and mediumsized companies worldwide, currently with more than 2,700 companies included. It provides a suitable target benchmark against which Fund performance will be measured and evaluated over time.

The Fund typically invests in fewer than 50 companies, which may include shares of some companies not within the Index. The Fund may invest in other securities (including fixed interest securities, convertible securities, and warrants) and collective investment schemes (including funds managed by Columbia Threadneedle companies), when deemed appropriate. The Fund may also hold money market instruments, deposits, cash and near cash. The Fund is not permitted to invest in derivatives for investment purposes, but derivatives may be used with the aim of reducing risk or managing the Fund more efficiently.

Other information: Many funds sold in the UK are grouped into sectors by the Investment Association (the trade body that represents UK investment managers), to facilitate comparison between funds with broadly similar characteristics (peer groups). This Fund is currently included in the IA Global sector. Performance data on funds within this sector may be used when evaluating the performance of this Fund.

Fund Manager

David Dudding is a senior portfolio manager at Columbia Threadneedle Investments. He joined the company as an equity research analyst in 1999 moving on to manage the European Smaller Companies strategy for 10 years until December 2012. He is currently responsible for the European Select and Global Focus strategies.

David previously worked for John Swire and Sons in Hong Kong and for Investors Chronicle as a financial journalist.

He holds a Modern History degree and a European Politics Masters degree from Oxford University. He also holds the Chartered Financial Analyst designation and is a member of the CFA Society of the UK.

Contact Us

Contact our Sales Support

Contact our regional sales team

Disclaimer