Balanced Commercial Property Trust performance

View the Trust’s latest results

View the latest performance figures, current holdings, and dividend information for Trust

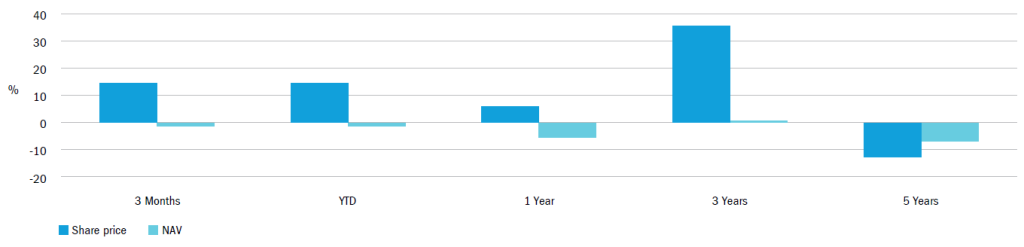

Performance (%) as at 31.01.24

Past Performance is not a guide to future performance.

Source: Datastream and CT. Basis: Percentage growth, total return, bid to bid price with income reinvested in sterling.

Cumulative performance | 3 month | Year to date | 1 Year | 3 Years | 5 Years |

|---|---|---|---|---|---|

Share price | 14.3 | 14.3 | 5.8 | 35.4 | -12.5 |

NAV | -1.1 | -1.1 | -5.5 | 0.6 | -6.9 |

Discrete annual performance | 2024/ 2023 | 2023/ 2022 | 2022/ 2021 | 2021/ 2020 | 2020/ 2019 |

|---|---|---|---|---|---|

Share price | 5.8 | -24.9 | 70.4 | -1.7 | -34.2 |

NAV | -5.5 | -14.5 | 24.5 | -1.9 | -5.7 |

Let's talk about risk

The value of your investments and any income from them can go down as well as up and you may not get back the original amount invested. Gearing is used for investment purposes to obtain, increase or reduce exposure to an asset, index or investment. The use of gearing can enhance returns to investors in a rising market, but if the market falls the losses may be greater.

The Trust's top 10 holdings

The trust aims to deliver an attractive income and long-term capital growth from a portfolio of UK commercial properties. There is a clear emphasis on the higher quality or ‘prime’ end of the property market and the portfolio is heavily biased towards Central London and the South East. Containing over 30 individual properties from across a range of sectors including retail, industrial and office premises the portfolio is well diversified. Each property in the portfolio is actively managed by the team to ensure it generates the best returns for shareholders.

Holdings | Sector | Geographical location | |

|---|---|---|---|

Properties valued in excess of £200 million: | |||

London W1, St Christopher’s Place Estate

| Mixed | West End | |

Properties valued between £50 million and £70 million: | |||

Solihull, Sears Retail Park | Retail Warehouse | West Midlands | |

Newbury, Newbury Retail Park | Retail Warehouse | South East | |

Properties valued between £40 million and £50 million: | |||

London SW19, Wimbledon Broadway | Mixed | South East | |

Winchester, Burma Road | Alternative | South East | |

Properties valued between £30 million and £40 million: | |||

Chorley, Wolseley RDC, Revolution Park

| Industrial | North West | |

Birmingham, Unit 8 Hams Hall Distribution Park | Industrial | West Midlands | |

Markham Vale, Orion One & Two | Industrial | East Midlands | |

Liverpool, Unit 1, G. Park, Portal Way | Industrial | North West | |

Daventry, Site E4, Daventry International Rail Freight Terminal | Industrial | East Midlands |

Latest dividend information

Please note – Since October 2019, and following conversion to a UK REIT, the majority of dividends are treated as Property Income Distributions and may be subject to withholding tax at source, depending on a shareholder’s circumstances, at the basic rate of UK income tax (currently at a rate of 20 per cent).

Dividend

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Information in this section of the Website is directed solely at persons who are located in the UK and can be categorised as retail clients. Nothing on this website is, or is intended to be, an offer, advice, or an invitation, to buy or sell any investments. Please read our full terms and conditions and the relevant Key Information Documents (“KID”) before proceeding further with any investment product referred to on this website. This website is not suitable for everyone, and if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product.