Balanced Commercial Property Trust

Investing in a diversified UK commercial property portfolio

The share price information is delayed by at least 15 minutes

On 15 April 2024, the Board of Balanced Commercial Property Trust Limited (the "Company") announced that it is undertaking a strategic review to consider the future of the Company and will further explore all of the various strategic options available to enhance value for shareholders.

For further information on the strategic review, please click here.

Richard Kirby, MRICS, joined Columbia Threadneedle Real Estate Partners (formerly BMO Real Estate Partners) in 1990. He has been a fund manager since 1995 and has experience of managing commercial property portfolios across all sectors for open-ended, closed-ended and life fund clients. Richard has been lead manager of the Balanced Commercial Property Trust since launch in 2005 where his responsibilities include advising on and implementing property portfolio strategy, sales, acquisitions, asset enhancement and management. He is a director and sits on both the Executive Committee and Investment Committee of Columbia Threadneedle Real Estate Partners. He is a Chartered Surveyor and a member of the Investment Property Forum and the British Council of Offices.

The trust is a vehicle for investors who wish to gain exposure to prime UK commercial property.

It is a constituent of the FTSE 250 Index and aims to provide shareholders with an attractive level of income together with the potential for capital and income growth from investing in a diversified UK commercial property portfolio. Dividends are paid on a monthly basis. The trust elected into the UK REIT regime from 3 June 2019.

Building value on strong foundations

Learn about our key strategic objectives

An income-led, total return strategy

A balanced portfolio

An active and opportunistic management strategy

A responsible ethos

Let's talk about risk

The value of your investments and any income from them can go down as well as up and you may not get back the original amount invested. Gearing is used for investment purposes to obtain, increase or reduce exposure to an asset, index or investment. The use of gearing can enhance returns to investors in a rising market, but if the market falls the losses may be greater.

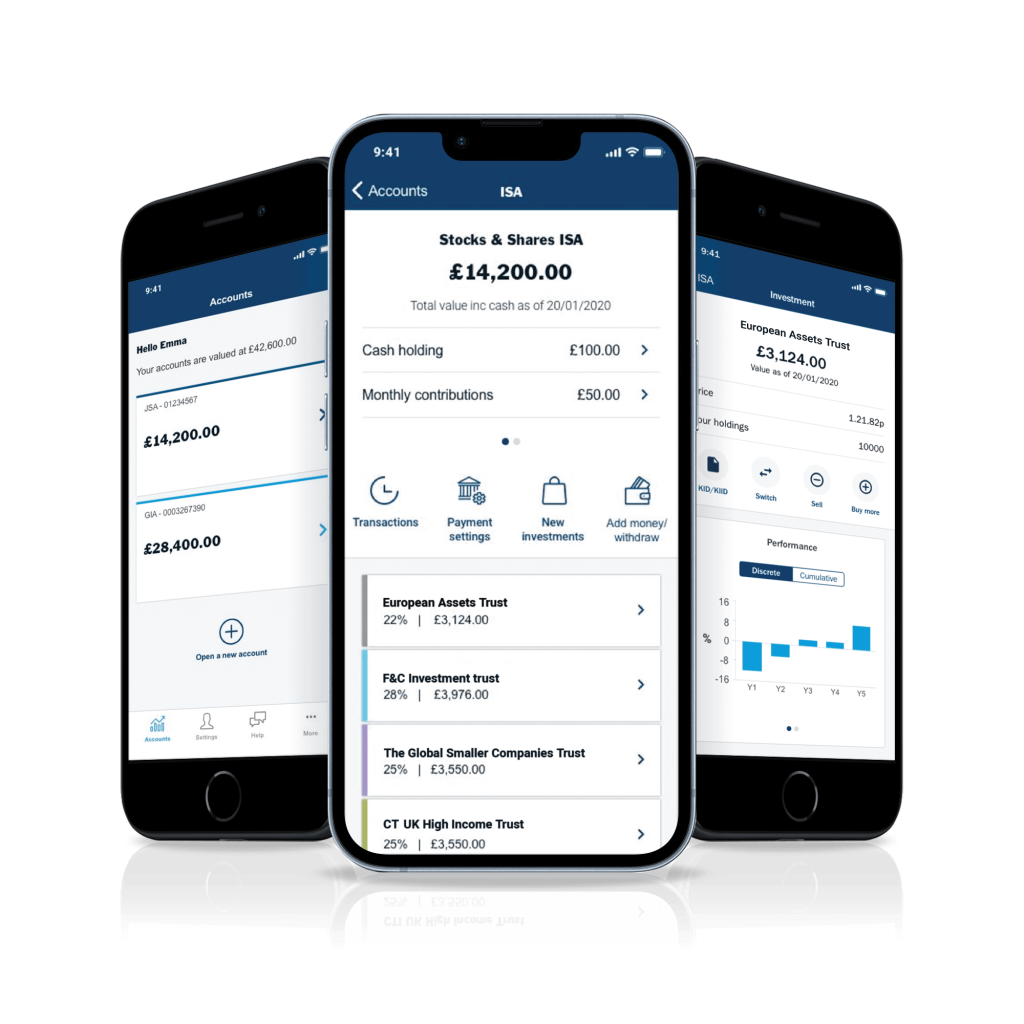

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Information in this section of the Website is directed solely at persons who are located in the UK and can be categorised as retail clients. Nothing on this website is, or is intended to be, an offer, advice, or an invitation, to buy or sell any investments. Please read our full terms and conditions and the relevant Key Information Documents (“KID”) before proceeding further with any investment product referred to on this website. This website is not suitable for everyone, and if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product.