Sense check – quarterly results

The Q1 2020 results season is upon us. Of course, we are long-term investors and aware of the lack of information in one quarter’s unaudited results. Nonetheless, we normally look forward to each results season as it can mark a return to fundamentals and away from whatever political, economic or other market-related issue is dominating at the time. Yes, the timescale covered is short but there can be clues as to whether our investment theses remain on track.

For most companies this time it’s different

This time is different, radically different. Except for businesses with large Chinese exposure, Q1 will capture little of the COVID-19 impact. That means they’re a snapshot of business across the world before everything changed. In every high street and shopping centre most of the shops are now closed, on every business park or industrial estate most businesses have paused operations. As we approach the summer in the Northern hemisphere the beaches, theme parks and other tourist destinations are all empty.

There are, as always, exceptions. Many healthcare businesses continue to operate but for most companies, the normal forward-looking comments that accompany results can be no more than a guess. Bar a few special cases, most countries that have introduced lockdown measures still have them in place. Even in China, experience varies widely, with many parts of the country continuing to enforce strict social distancing and other restrictions. Encouragingly, it appears that we can start thinking about exit strategies but until such time as we have some certainty it is difficult to think too far ahead.

Normal will be different

And then when we start resuming ‘normal’ life and head back to work, what will be the new normal? What will be the shape of the recovery? There are a plethora of different views but the truth is no-one knows. The COVID-19 pandemic and its impact is unprecedented and there is no comparison to draw on in modern economic history, not 2008/9, nor the early 2000’s not even the 1930’s. Perhaps the famously styled ‘four most dangerous words in investment’ are true – “This time it’s different!” Never before outside of wartime, have we seen such an abrupt cessation of economic activity. There are no neutral countries this time, just different magnitudes of impact.

When we move towards the ‘new normal’ there are lots of questions to be asked. And as we start getting clarity then maybe companies will be better placed to offer more reliable guidance on the future.

The big questions

- Does the crisis and the collapse in oil price advance the climate change debate greatly or delay transition to a low carbon world in the face of super cheap oil and more immediate things to worry about?

- Do supply chains become less global as countries worry about not having the ability to manufacture important components at home? What are the impacts of this on efficiency and inflation?

- Does the way we consume change, do we rush back to eating out or do we realise the benefits both on cost and on family make-up of eating at home?

- How quickly, especially in the absence of a vaccine, are we prepared to return to using urban mass transit or gather at big events such as concerts, festivals and conferences?

- Many people are working from home – the tech works, it can be done and the commute is a lot easier. Do we go back to previous working patterns and if not, what are the implications for office property and the service industries around them?

- And what about all those people who aren’t working – those that are already unemployed or the many who will be once government support runs out? What is the impact on consumption, the single largest contributor to GDP in all developed economies?

- The really big one for European investors is what happens to the Eurozone if they cannot agree on at least limited mutualisation of debt as the split between the North and South widens?

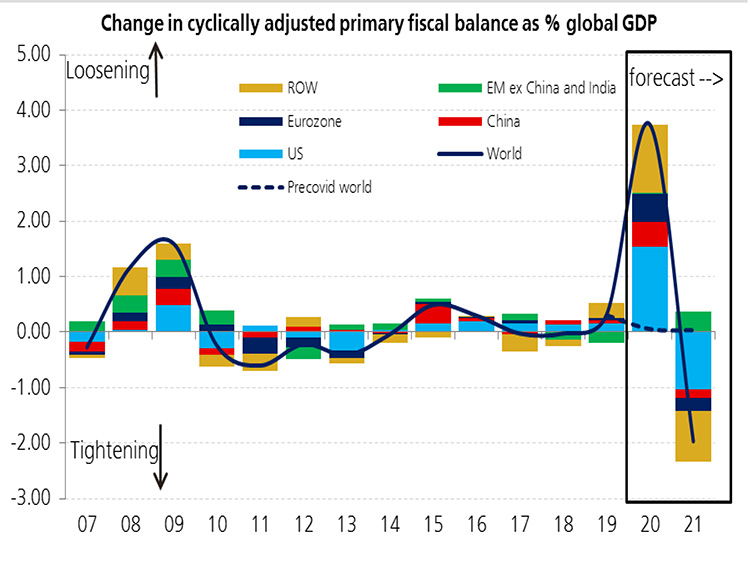

- Lastly, how do we ever pay back the enormous quantum of debt that’s being taken on to drive a fiscal stimulus that dwarfs the Global Financial Crisis? It is difficult to see austerity being the answer for repayment this time around.

Fiscal stimulus – the most expansionary year since 2009

Source: UBS, Haver, European Commission, CBO

Companies can provide little concrete guidance (and nor can analysts)

Some pretty big questions that need answering plus no doubt lots more that will emerge. No company management team can answer these, nor can they really give us an educated guess and if they can’t guide us then the analyst community is equally in the dark. After all, all analysts and most investors take our lead on the direction of future profits from the companies. The result, in our opinion is that we have seen far less earnings downgrades than we should have. In our view, stock markets currently have re-rated to reflect expectations around the downturn in Q1 and Q2 with an assumption of a big bounce back in H2 and 2021.

Current earnings expectations

2020e EPS Current | Growth, % Jan ’20 | 2021e EPS Current | Growth, % Jan ’20 | |

|---|---|---|---|---|

MSCI World | -7.8% | 8.9% | 17.0% | 9.8% |

S&P 500 | -9.1% | 9.0% | 18.3% | 10.9% |

Stoxx 600 | -11.3% | 8.6% | 18.1% | 8.4% |

Euro Stoxx | -10.1% | 10.3% | 19.8% | 9.2% |

FTSE 100 | -22.1% | 6.7% | 20.8% | 5.7% |

Topix* | 9.2% | 9.6% | 13.0% | 8.8% |

EM | 6.6% | 15.0% | 18.3% | 13.2% |

Source: IBES. *Topix refers to FY ending Mar’21 and ‘22

‘Quality, management and valuation’ remains our mantra

What do current events and lack of future clarity mean for us in the Columbia Threadneedle European equity team? In some respects, not a lot. Anyone who has met us in the last 10 years will have heard us talk about the three things we look for – ‘quality, management and valuation’ and we believe a focus on these elements will hold us in good stead in the world we now find ourselves. A focus on strong balance sheets and good liquidity run by management teams that have consistently run their businesses for long-term shareholders remains key as this will better ensure a business can survive. Valuation had been key for us as many quality businesses were valued in a way that left us with no margin of safety. March saw that change in some circumstances, and during the indiscriminate sell-off we took the opportunity to upgrade the quality of our portfolios even further. Additions included companies such as Ferrari, Lonza and Ubisoft, all highly liquid with business models we are confident will thrive into the future at valuations we haven’t seen for some time.

The good news is clearly that authorities have learnt lessons from the past and responded, in the main, quickly and aggressively with both monetary and fiscal stimulus. Our hope is that this limits the downside and we see a quick recovery. Of course, there is the fear is that we don’t and that both the direct impact of COVID-19 and the economic and societal impacts that follow will be bigger than anticipated. Whatever the outcome, our focus will remain on buying good businesses at attractive prices, run by management teams that understand they run the business on behalf of shareholders. Why? Because we believe that this approach is the best way to grow our clients’ capital over the long-term whilst at the same time protecting it during more difficult times.