The wonder of hindsight, and the age-old comment, “I told you so”. In our 2018 review, we said there was no way to sugar-coat the year – it had been the worst year for equities since 2008. In the same breath, we also stated: this is not a time “to panic”, or as Buffett put it, “to be the idiot”.

Whilst those around us capitulated, and greed turned to fear, we held steady and continued buying more of the weaker names. Was this easy? No, and it’s not meant to be. But our experience has taught us one thing: capitulating at the point of most fear is ‘rarely’ the right thing to do.

Nothing has fundamentally changed

Our year’s performance was a function of what we have done over many years, not just in 2019. In 2018 we underperformed, but the difference isn’t the fundamentals of the stocks, but rather the market’s perception of them. Throughout this time, we’ve maintained our focus on strong and attractively valued businesses held on a long- term view. Therefore, the very reason we underperformed in 2018 – maintaining our conviction – was the reason we outperformed in 2019. When you run high conviction portfolios you don’t need many things to go right. An average position size of 4% means that those that begin to perform can make a significant difference.

What changed, if anything, in 2019?

It was a year during which there was a lot of background noise to deal with – Brexit, the China-US trade war, Hong Kong protests, and the general global economic slowdown, which seemed to take a back seat. For us, the biggest shift was in expectations post a very weak final quarter of 2018. We not only witnessed a sharp derating; in tandem we had a raft of analyst downgrades. That meant European earnings were negative as we entered the year, etching a negative outcome for 2019 into the minds of investors.

A bottom-up perspective

We regularly remind our clients that we spend little time worrying about how to build a portfolio from a macro perspective. Our focus is on the qualities of the businesses, their moat (competitive advantage), structural growth prospects and, ultimately, their cash-flow. The market will then decide whether it likes the business and what valuation it will ascribe. We have long talked about the perils of ‘expensive quality’, so the rotation in Q4 2019 was a welcome start, though not yet a prolonged shift towards value. Growth at the right price is key to us – there are a number of ‘quality businesses’ we would love to own, it is just that our disciplined approach to the price we pay precludes us from doing so.

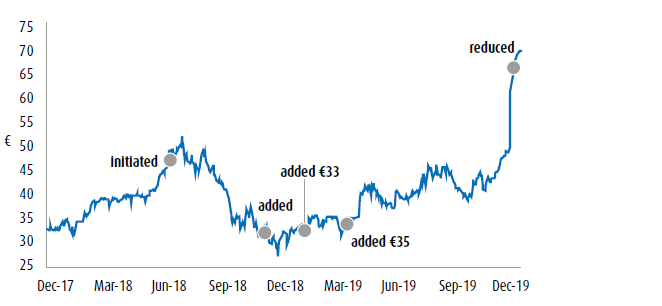

Delivery Hero, share price and fund activity

Source: Bloomberg as at 31-Dec-19

Delivery Hero – no profit yet but huge potential

Post the share price peak in the summer of 2018, they proceeded to announce the sale of their German business to Takeaway.com but coupled this with a huge investment programme that would depress short-term profitability. The share price subsequently slid to a low of €31. Despite the short-term disappointment, we retained the view that the food delivery platforms have very strong market positions, for the ones that have survived, and the barriers to entry in this market are significant. This will allow them to monetise their core markets once they get over the investment and consolidation hurdles. In December 2019, Delivery Hero announced a deal in Korea to acquire their main competitor. Korea has been a major battleground in the Asian region and was a key asset for Delivery Hero to win, locally and for the region. The valuation for the deal was well received for a high-growth asset and helped to drive the share price to all-time highs, closing the year just above €70.

Technology

Where from here?

We believe that the stability of our portfolios should also provide comfort – we don’t need any new names, although it would be nice to have one or two quality names (we don’t own) profit warn. As a team we avoid chasing themes or trends and avoid listening to short-term noise about what the market thinks investors should own. Our focus is on fundamentals and companies we believe will deliver in time.