CT General Investment Account

Harness stock market potential with a flexible

savings plan.

General Investment Account (GIA) explained

Our General Investment Account (CT GIA) is one of our most flexible solutions for long-term investors.

If you’re looking to pay off your mortgage, invest for retirement or just build a portfolio, a General Investment Account (GIA) can help you harness the potential of the stock market to reach your investing goals without any investment limits.

The CT GIA could be the right solution if you’ve maxed out your ISA allowance for the year.

Reasons to choose Columbia Threadneedle for your General investment Account

No online dealing charges

Benefit from our expertise

Responsible Investing

Investment Trust Options

Getting started is easy

3steps towards your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

The value of your investments and any income from them can go down as well as up and you may not get back the original amount invested. Columbia Threadneedle Management Limited is authorised and regulated by the Financial Conduct Authority and assets are protected by the Financial Services Compensation Scheme.

A cost-effective way to invest.

Invest from as little as £25, with no dealing charges on investments made by a monthly direct debit. One-off contributions, sales and switches can be made online without any dealing charges. If you need to send instructions via post, there will be a £12 charge for each fund selected.

There’s an annual charge of £40 + VAT for the CT General Investment Account and Government stamp duty of 0.5% applies on purchases of UK shares.

Make sure you read the pre-sales costs disclosure before you invest.

Invest in our Investment Trusts through a CT GIA

With a CT General Investment Account you invest through our diverse range of Investment Trusts.

Our Investment Trusts provide a range of investment opportunities, including access to equities, bonds, property and private equity.

Each trust has different aims and strategies. You can select a trust that aims for capital growth, income or both. Some have a specific regional focus, while others take a global approach.

Please see the Key Information Documents (KIDs) for further details on the risks for each trust. View the latest performance of our Investment Trusts.

Invest now

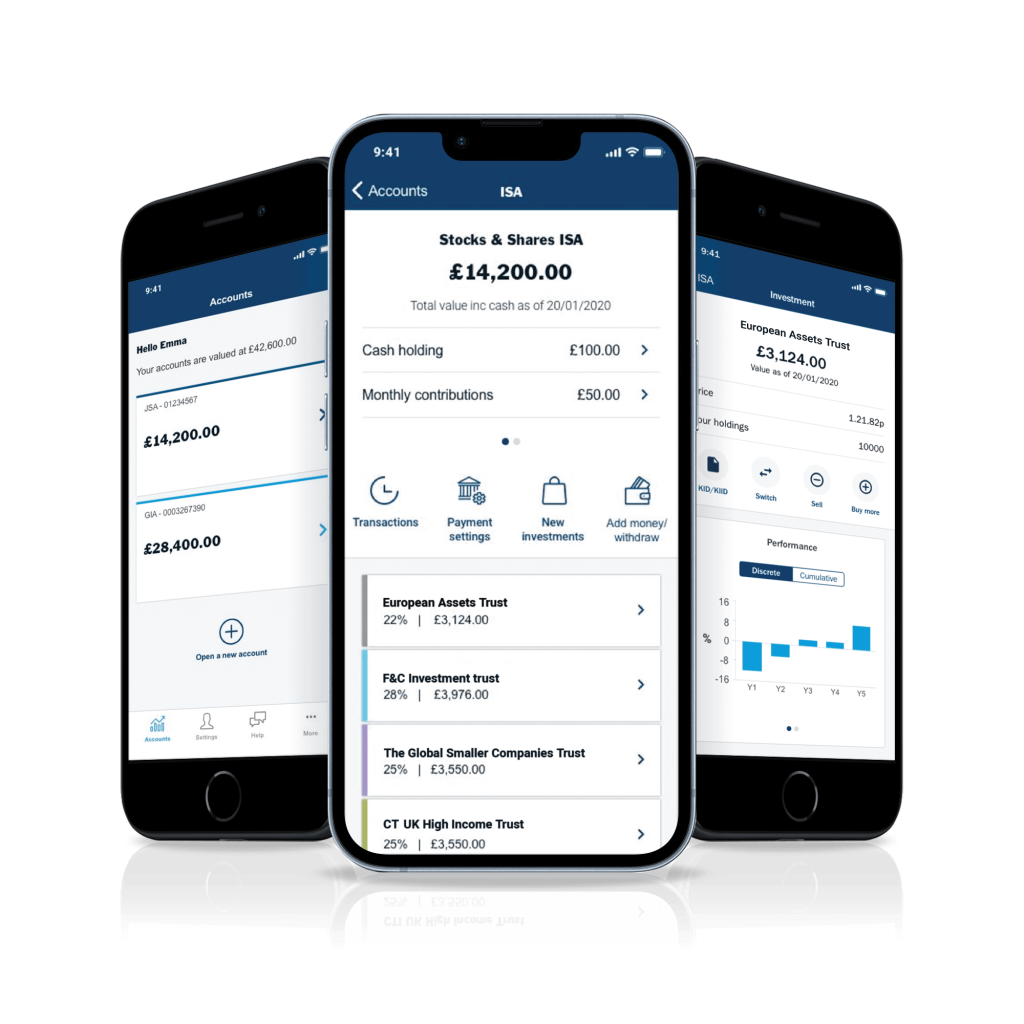

Columbia Threadneedle offers a range of Savings Plans designed to make investing easy.

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Frequently asked questions about our CT General Investment Account

No maximum limits – there is no annual limit so you can invest as much as you like into a GIA.

This type of account is not a tax efficient wrapper (like an ISA for instance), and you will have to pay tax on any interest or capital gains earned.