CT Global Emerging Markets Equity Fund

Consistently disciplined in pursuit of emerging opportunities

A disciplined, bottom-up approach led by a team skilled and equipped to seek out emerging market ‘stewards of capital’, businesses capable of sustaining and accelerating profitable growth.

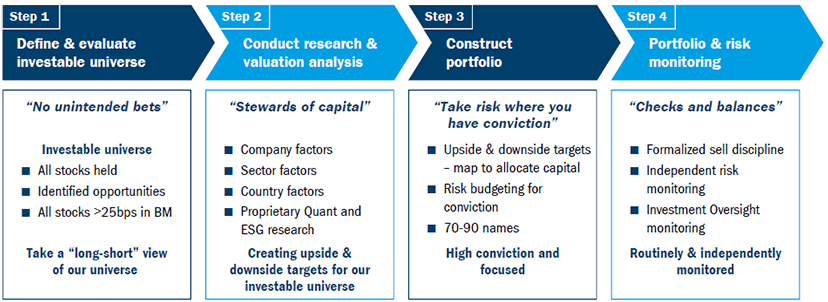

“Particularly in emerging markets, the market tends to fade the growth of well-run businesses too quickly and it’s this inefficiency that we have consistently looked to exploit. We favour ‘stewards of capital’ – companies that can sustain and accelerate profitable growth with an emphasis on shareholder returns. We combine this with our tenet of ‘no unintended bets’ setting upside and downside price targets on all stocks, creating an informed view of our defined universe with the aim of delivering attractive, consistent long-term returns for our investors.”

Dara White – Global Head of Emerging Markets

Overview

True all-cap strategy

A proven ability to generate alpha across the market cap scale

Disciplined investment process

No unintended bets: our disciplined approach sets upside and downside price targets on all stocks within our defined investment universe

Stability of the team

Specialist and experienced Emerging Market investors with a stable team since their inception in 2008

Investment Philosophy

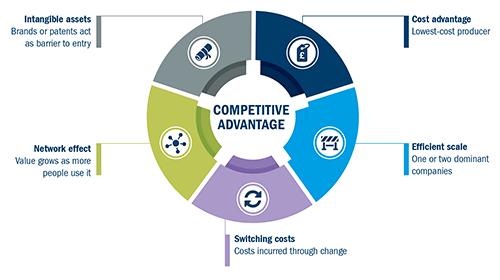

Why we like high-quality businesses:

- We believe in the long-run, companies with competitive advantage, financial strength and strong management teams and whom operate in an industry with certain growth potential will generate sustainable growth and returns for shareholders

- We seek out those companies, not just with attractive growth rates, but a high return on invested capital with the ability to sustain profitable growth – creating value in the long term

Investment process: Clearly defined and repeatable

Insights

Market Monitor – 19 April 2024

Market Monitor – 19 April 2024

Fund Manager

Dara White is the global head of emerging market equities at Columbia Threadneedle Investments and has acted as lead portfolio manager of emerging market equity strategies since 2008. He joined the company in 2006 as co-manager of the strategic investor team and is based in Portland. Prior to this, Dara was a portfolio manager and analyst with RCM Global Investors. Dara received a degree in finance and marketing from Boston College. He is a member of the CFA Institute and the Security Analysts of San Francisco. In addition, he holds the Chartered Financial Analyst designation.

Important information

Fund objective

The Fund aims to increase the value of your investment over the long term. It looks to outperform the MSCI Emerging Markets Index over rolling 3-year periods, after the deduction of charges.

The Fund is actively managed, and invests at least 75% of its assets in shares of Emerging Market companies.

The Fund selects companies considered to have good prospects for share price growth, from any industry or economic sector, and whilst there is no restriction on size, investment tends to focus on larger companies, such as those included in the MSCI Emerging Markets Index. The MSCI Emerging Index is designed to capture the share performance of large and medium-sized companies across Emerging Markets worldwide, with more than 1,000 companies included. It provides a suitable target benchmark against which Fund performance will be measured and evaluated over time.

The Fund typically invests in fewer than 100 companies, which may include the shares of some companies not within the Index. The Fund may invest up to 30% of its value in China A-Shares through the China-Hong Kong Stock Connect Programme. The Fund may also invest in other assets such as cash and deposits, and hold other funds (including funds managed by Columbia Threadneedle companies) when deemed appropriate.

Get in touch

Telephone

*Please note calls are recorded

Contact our sales support team

Important information: Past performance is no guide to future returns. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Your capital is at risk. Threadneedle Specialist Investments Funds ICVC (“TSIF”) is an open-ended investment company structured as an umbrella company, incorporated in England and Wales, authorised and regulated in the UK by the Financial Conduct Authority (FCA) as a UCITS scheme. Certain sub-funds of TSIF are registered for public offer in Austria, Belgium, Chile, Denmark, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Singapore, Spain, Switzerland, Sweden and the UK. Shares in the Funds may not be offered to the public in any other country and this document must not be issued, circulated or distributed other than in circumstances which do not constitute an offer to the public and are in accordance with applicable local legislation. Please read the Prospectus before investing. Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the `Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. The above documents are available in English, French, German, Portuguese, Italian, Spanish and Dutch (no Dutch Prospectus), Swedish (for the Key Investor Information Document only) and can be obtained free of charge on request from: Columbia Threadneedle Investments PO Box 10033, Chelmsford, Essex CM99 2AL. Issued by Threadneedle Investment Services Limited. Registered in England and Wales, Registered No. 3701768, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. columbiathreadneedle.com