The robots have been on the march for some time now – welding, handling packages, loading and unloading, assembling and gluing, and busily painting away on manufacturing sites. By the end of 2020, there were 3 million industrial robots in operation globally, a population equal to that of Milan’s, and three times higher than in 2010.

But COVID-19, and the consequent lockdowns, should serve to accelerate these pre-existing trends towards greater automation. When the pandemic hit, country by country, people were dispatched to their homes, workplaces fell silent, shops furloughed, factories ground to a halt, sharply exposing the potential fragility of global supply chains. In a connected world, with people and goods washing across borders, a pandemic can dislocate whole swathes of the global economy, causing economic disruption, product shortages (it started with the stockpiling of toilet paper; it ended with a dearth of semi-conductors) and the sort of 6-7% inflation prints we’re seeing coming down the pipeline in the U.S. and elsewhere.

Robots don’t call in sick

Enter automation. Robots and algorithms don’t cough. They don’t shake hands. They don’t get sick. They can work unflinchingly through a pandemic. They are anti-fragile. Global automation investment bottomed in the April-June quarter in 2020, as budgets panic-froze, but since then we have seen 6 consecutive quarters of upcycle in the space. In China, robot sales hit a record level in 2020, reaching 168,400 units, and then surpassed this, with CLSA estimating a further 200,000 robots sold in 2021, making China the first country in the world to surpass an installed robot base of 1 million. The density of robots in China (robots installed for every 10,000 workers) has risen more than 5 times since 2015. The country now counts for just under a third of all the world’s installed robots.

China’s share of global installed robots

Source: CLSA, IFR World Robotics 2021

But the automation boom is global. North America saw record quarterly robot orders in 2021, both in volume and value terms. When McKinsey surveyed 800 senior executives in summer 2020, two thirds said they were stepping up investment in automation and artificial intelligence as a consequence. But there is still huge variance between countries, with hyper roboticized countries like Korea and Singapore seven times as automated as the global average, and dozens of times more automated than the global laggards.

Robot density in the manufacturing industry 2020

Source: World Robotics 2021

Mind the population gap

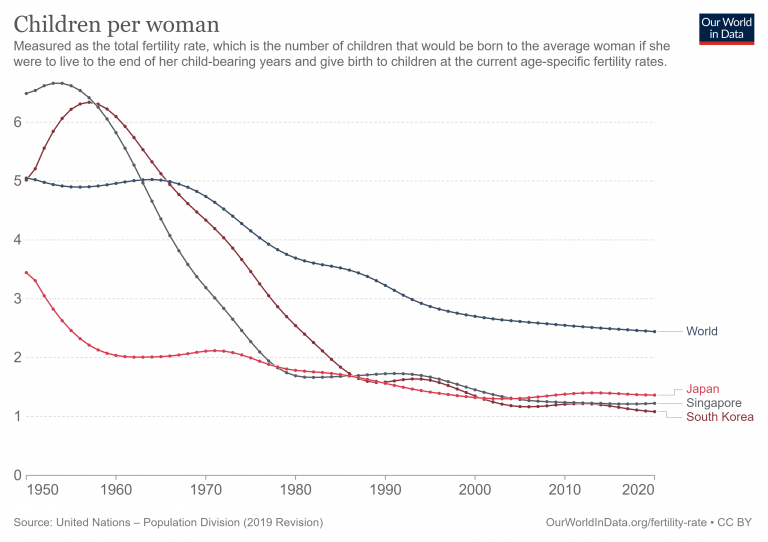

It is no coincidence that these leaders in automation are also countries with the lowest birth-rates. Korea’s fertility rate of 0.84 babies per woman last year may be the lowest in human history, and it is expected to fall further, to 0.74 by 2024, according to the country’s finance ministry and the statistics office. This extraordinary rate is ~1/3 that needed to keep a population stable. South Korea may be an extreme, but it is emblematic of broader developed (and even developing) market trends.

This demographic shortage is another mega-driver supporting automation investment, with inverted population pyramids creating acute labour shortages in the decades to come.

Broader applications

Automation demand is spreading beyond the old bastion of the auto industry and into increasingly diverse sectors. H1 2021 was the first half year in U.S. when more than 10,000 industrial robots were ordered outside of the auto industry. Worldwide, one third of robots installed are in the auto industry, 25% in electronics, and 10% in the metal industry, but in Japan, service sector robots are expected to grow by a multiple of 13 by 2035, overtaking industrial demand. Smaller, more precise robots are making inroads into healthcare, pharmaceuticals, food and consumer goods.

Investment opportunities – vision, data, and contactless payments

As investors, we try to position ourselves downstream of these resources that are cascading into automation. One company poised to be a key participant is Keyence, the Japanese leader in machine vision technology. Keyence makes sensors, industrial microscopes, measurement systems and barcode readers. It can be thought of as the eyes of the world’s automation industry, plugged into the processes of thousands of companies across the world’s most vital sectors, from automotive assembly to semi-conductor manufacturing to food and pharma. Keyence’s products can inspect pharmaceutical packaging to ensure labelling is correct and expiration dates haven’t been passed. It can check the same packages to make sure they are sealed and haven’t been tampered with. Its sensors can look into a box of biscuits to check that the correct number are in there, ensuring no one is short-changed at the supermarket, or its ultra-high-speed cameras can scan hundreds of cans of fish, onions or beans per minute in a factory to ensure that none have broken seals. Its vision systems can measure seat belt buckles to ensure they are precisely correct in size and shape, saving lives on the road. Its lasers can measure the exact thickness of a glass substrate within electronic components, ensuring the most high-tech equipment on the planet functions properly, or inspect watchmaking equipment, where tolerance intervals are between 2 and 8 μm.

Keyence’s sales staff go direct to clients and create bespoke automation solutions for them, and its value-add products command 80% gross margins. Keyence still makes 40% of its revenue in Japan, which, given its demographics, has been a great test-case for a world with fewer young workers. But the global growth runway is enormous. Keyence was already a beneficiary of a world where precision and scientific accuracy is at an ever-greater premium, but COVID-19 has been an accelerant to this trend, more and more customers trying to remove error and fragility from their processes. Keyence hit back-to-back record high revenue and profit quarters in its most recent two earnings releases in 2021.

Much of the world’s automation relies on seamless, high speed data connectivity. Data collection and distribution is needed to connect devices and to feed the algorithms that are translated into decisions or actions. Crown Castle owns, operates and leases towers and other telecoms infrastructure in the U.S. to ensure a strong communications backbone. Its 5G products can be important facilitators of autonomous cars and connected transportation systems, which generate and receive constant streams of data that are analysed to make decisions around safety and optimisation of routes. An autonomous vehicle can generate 4KGBs of data every single day, and this requires powerful data connectivity, which Crown Castle is an enabler of.

Finally, COVID-19 may have been the final push needed to hasten the demise of the cash era, accelerating the transition across to digital, contactless payments. When the pandemic struck, physical items of payment suddenly became objects of suspicion. The People’s Bank of China started sealing and storing used banknotes for up to 14 days and disinfecting them thoroughly. Shops and supermarkets shut their tills. As a result, contactless payments increased at the fastest rate in years, with instore mobile contactless payments increasing 29% YoY in the U.S. in 2020. We are invested in Apple, whose digital wallet Apple Pay grew by more than 65mn users to a total base of over half a billion people in 2020, enabling people to pay for things without cash, and with less human interaction. Mastercard and PayPal are also key enablers of digitalised, more automated payment systems, and have been strengthened by covid and lockdowns.

As investors, we need to understand what the post-covid landscape might look like, and what sort of positive developments might be catalysed by one of the great disasters of our time, and we need to try to be positioned for these changes.