Over an unprecedented 12 months commercial property funds have proven their resilience as stable income generators. Here, we look at how the market is changing and evolving to ensure it delivers for investors in the years to come. Key takeaways from 2020 are threefold: portfolios have adapted to reflect structural and demographic trends; income generation has proved resilient; and as a consequence we believe the industry is well positioned to meet the challenges ahead.

2020, a year like no other

In March 2020, in the aftermath of the World Health Organisation declaring Covid-19 a global pandemic, we shared our views on the outlook for the UK real estate market, suggesting that while real estate was not immune from the forces affecting the global economy, it was well placed to weather the storm. We expected potentially significant variations in sector performance, in part accelerating trends already apparent prior to the pandemic.

That analysis proved correct on both counts: our asset class has successfully weathered significant headwinds; and has emerged resilient and reoriented to benefit from the anticipated economic recovery ahead. Forecasts which envisaged a collapse in capital values proved wildly pessimistic; values declined by just 5.8% in the year to end February 2021 almost entirely offset by positive income returns of 5.6%.1

The failures of high-profile retailers such as Debenhams and Arcadia masked a quiet shift in the industry as it constantly seeks to mitigate risk and reposition itself to deal with future challenges. The asset class has survived and is well placed to thrive.

Repositioned for growth

One reason to be optimistic about the prospects for property as an investible asset class is its ability to adapt to the macroeconomic and demographic changes which have driven a high degree of sector performance divergence. Investors rightfully expect managers of balanced/diversified funds to actively position portfolios to maximise performance from identifiable long-term trends.

The most obvious example of this is the migration of retail online, accelerated by the pandemic, which has dramatically impacted many town centres but left a nationwide shortage of logistics space, leading to sustained increases in industrial rents and corresponding compression of yields in that sector as investors have piled-in to an asset class considered a safe haven.

Far from being blind to this shift, pro-active managers have reduced their shopping centre and high street retail exposure and increased their weightings to industrial and logistics. Within the MSCI UK Property Monthly Index, net disinvestment from retail has totalled £3.6 billion over the past five years, averaging £60 million a month. As sales proceeds are redeployed into the industrial sector, its market share – and hence performance contribution – has increased, to the extent it now accounts for 37.3% of the index (as at end-February 2021).2

This active bias toward better-performing parts of the market is not widely highlighted, but warrants focus given its disproportionately positive impact on market returns. Returns from industrial and logistics assets show no sign of slowing, which will continue to support market returns over the short term.

So, is it all about sheds?

Industrials aren’t the only reason to be positive about property. Within the retail sector, a spectrum has emerged drawing clear distinction between: those assets that are going from strength to strength (supermarkets, discount and bulky retail warehouses); those that are fit for purpose but require rental rebasing (fashion parks, dominant city and town centres); and those that require wholesale repurposing (shopping centres).

The good news is that this isn’t new news, and much of the rebasing required within the sector has already been done, with rental values falling 17% since April 2018 and capital values rebasing 38% since January 20183. Evidence across our portfolios suggests estimated rental values (ERVs) and capital values are largely marked to market, and in some instances we are concluding transactions ahead of valuation expectation. This presents an opportunity for entrepreneurial investors to take advantage of favourable pricing and upweight portfolios to benefit from the recovery of assets that now look over-sold. We continue to actively deploy capital into the retail warehouse sector.

Finally, a word on offices, which we believe continue to have a place in corporate inventories and contribute positively to social wellbeing, culture and productivity. An increasing number of business leaders have recognised that while the working from home experiment has been successful in the short term, most employees cannot continue to work from home indefinitely. Social distancing is likely to reverse the trend towards higher occupational densities, and office planners will need to re-think the balance of space dedicated to desks, meeting rooms and client-facing areas.

Supply remains reassuringly constrained in most office centres – an estimated 52.3 million square feet in England has been converted to residential under permitted development rights (PDR) since 2015, contributing to a 49% reduction of regional secondary supply since 20094. While we accept the sector is unlikely to escape entirely pain-free, evidence suggests any rental falls will be significantly less than in previous recessions.

Maintaining income yield

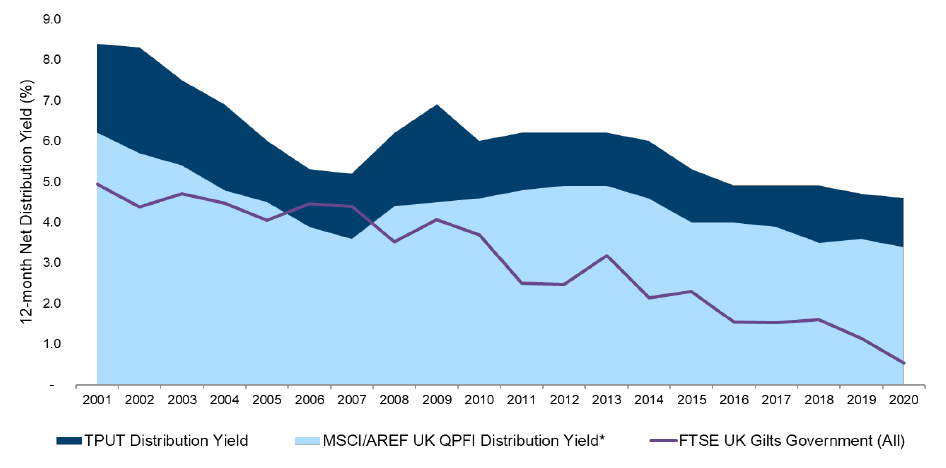

The resilience of rental income is one of the key takeaways of the past 12 months. The asset class currently offers a net income yield of 5%5 which provides a compelling investment case in the context of current gilt pricing (see Figure 2).

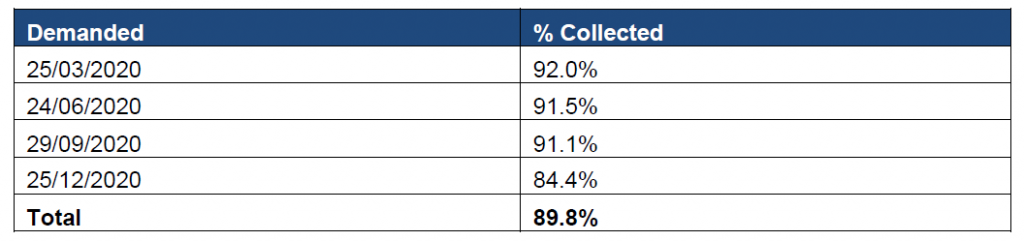

Government action supporting commercial tenants, the effect of which has limited landlord recourse for non-payment of rent, has put rent collection under understandable scrutiny, but collection across our balanced portfolios has held up very well, averaging 89.8%.

We have taken time to engage with our occupiers and arrange payment plans, rent deferrals or monthly rents where necessary to ensure tenants can survive through multiple government-mandated “lockdowns”, taking the opportunity to re-gear leases, lengthen terms or remove breaks in return for rental holidays, to the benefit of both landlord and tenants. This is an ongoing process and is reflected in increasing levels of rent collection through and beyond each of the past four quarters (Figure 1).

Figure 1: Rent collection – Columbia Threadneedle Investments balanced funds

Source: Columbia Threadneedle Investments, 18 March 2021.

Our longstanding focus on pro-active asset management gives us the confidence to invest in assets offering shorter leases than is typical of the wider market, as we know from experience that tenants in well-managed buildings rarely operate break options and our investors can therefore benefit from the high and sustainable income yields these assets offer.

By way of illustration, less than 9.5% of break options were exercised on our UK Balanced Institutional fund in 2020, which allowed it to deliver a net distribution yield of 4.6% against its peer group of 3.4%.6

Figure 2: Net income yields – UK real estate and gilts

Source: Columbia Threadneedle Investments & MSCI, 31 December 2020. TPUT refers to the Threadneedle Property Unit Trust. *UK Other Balanced Property Funds Index (excluding Managed Property Funds). All periods as at 31 December.

The challenge ahead

Unprecedented is an often-over-used term; however, it is justifiable to describe the past few years’ macroeconomic environment, which has seen us simultaneously rewrite the relationship with our largest trading partner and deal with a global pandemic. Commercial property has successfully navigated these challenges and emerged resilient.

The industry must demonstrate equal dynamism to meet the biggest challenge of all: how to reduce its impact on the environment and limit climate change. Environmental, social and governance (ESG) has rightly moved to the forefront of legislative and corporate agendas, and stewards of capital managing the built environment must adapt to remain relevant. As pioneers of carbon neutral investing through our Carbon Neutral Real Estate Fund, we remain wholeheartedly committed to this agenda and will shortly publish details on our proposed pathway to achieve carbon neutrality across our portfolios.

Conclusion

Real estate is not as static as some may assume. The asset class continues to demonstrate its ability to meet the changing demands of occupiers, investors and regulators with admirable credit. Away from the spotlight, a pragmatic re-weighting exercise has ensured balanced funds continue to remain relevant and positioned to deliver performance to investors, mitigating risk through active management and continuing to deliver resilient income returns.

While we accept residual headwinds remain, evidence suggests that at market level, capital values have largely rebased, returning to positive growth in November 2020. Anecdotal evidence suggests significant capital remains undeployed in some sectors, notably logistics, which, other things being equal, would imply a quicker recovery in returns over the course of 2021 than many anticipate.