Fund Watch uses our team’s process to highlight the past quarter’s developments in the fund world. It is fact-based and uses performance analysis techniques which form part of our investment process. All data is from Lipper for Investment Association (IA) sectors and is calculated in total return terms in sterling for periods ending 31 March 2022.

This quarter’s report includes the following analysis:

- The Columbia Threadneedle Investments MM Consistency Ratio – highlighting the surprisingly limited number of funds beating their peers on a regular basis.

- Tops and Bottoms – the ultimate winners and losers over the quarter.

- Sector Skews – the best and worst of the 52 IA sector averages.

- Risky Business – a look at the leading funds for combining first class longer-term returns with the lowest levels of volatility.

The Columbia Threadneedle Investments MM Consistency Ratio

Source: Lipper, 31-Dec-21 to 31-Mar-22, percentage growth, total return.

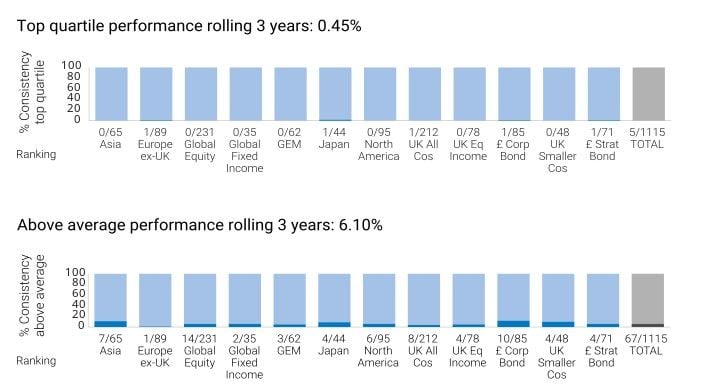

Here we review of 12 major market sectors, filtering out only those funds that are consistently above average in each of the last three 12-month periods, and those consistently in the top quartile. In the 12 main sectors researched, there are currently 1,115 funds with a 3-year track record.

- The Columbia Threadneedle Investments MM Consistency Ratio for top quartile returns over three years (to the end of Q1 2022) has been significantly impacted by the invasion of Ukraine by Russia, and its huge geopolitical impact on resources, different geographies and global interest rates and currency markets. The ratio has tumbled to an all-time low of 0.45% (2.1% last time) with just 5 of the 1,115 funds achieving this feat. This ratio’s typical range over the time we have been running this research was c.2-4%.

- Only five funds from five different sectors manage the consistency of top quartile returns – the sectors are the IA Europe ex-UK, the IA UK All Companies, IA £ Corporate Bond, IA £ Strategic Bond and IA Japan. These are interesting times!

- Lowering the hurdle rate to simply above median in each of the last three 12-month periods saw another new low of just 65 of the 1,115 funds delivering compared to 159 funds last quarter. This means our less demanding ratio collapsed from 14.6% to 6.1%.

- All 12 main IA sectors managed to contain funds that met the less demanding above median consistency hurdle. The most consistent sector on this measure was IA £ Corporate Bond with 11.8%, then came IA Asia Pacific ex- Japan with 10.8% of funds performing above median for 3 consecutive years. The IA Europe ex-UK sector was the least consistent with just one, or 1.1% of funds, achieving the above median consistency hurdle.

Columbia Threadneedle Investments MM comment

- The three years that this survey covers have been extraordinary for the real world and this has caused significant gyrations in many financial markets and underlying asset classes. To the unprecedented impact of Covid, deflation followed by inflation, the influences of climate change and related ESG considerations, we can now add war and the resulting sanction impacts on commodities, inflation and rates, together with a resurgent interest in long-ignored sectors such as defence. These conditions have conspired to see the lowest consistency figures we have ever seen.

- One bi-product was that Q1 2022 was the worst quarterly performance for long-duration US fixed income in memory and if using the 20% fall definition of a bear market, then the first bear market for US long-duration at least since 1982 according to one strategist we follow.

- From these chaotic conditions some new performance trends may emerge, and we may continue to see the impact of this quarter on consistency of returns and volatility for some time to come.

Tops and bottoms

Identifying the best and worst performers of all funds in the quarter across all 52 IA sectors.

- The Liontrust Russia fund suffered a turbulent quarter with suspension of the fund lasting most of March. Fund manager Thomas Smith clearly could not hide from the storm and the fund recorded a fall of 64%.

- One manager’s misfortune is another’s luck and Bosch de Hood, manager of JPM Brazil Equity fund, found himself with a following wind in Q1 2022 as resource-rich Brazil was in favour after being out in the cold for some time. The fund rose 36%.

Source: Lipper, 31-Dec-21 to 31-Mar-22, percentage growth, total return.

Sector skews

Identifying the best and worst performers in the quarter across all 52 IA sectors.

- Only 4 of the 52 IA sectors made positive ground in the first quarter of 2022. Already-rising bond yields and commodity prices were exacerbated by the unexpected invasion of Ukraine and the global sanction responses.

- The IA Latin American sector topped a table of IA sector averages gaining an impressive 26.5% as the resource-rich region benefitted from Russia’s position in the commodities markets being questioned.

- The IA Commodities and Natural Resources sector (compromising of 13 funds) was next best for the second quarter in a row gaining 13.5% after 7.3% last time around.

- The straggler was the IA European Smaller Companies sector which fell 13.4% as the already less-liquid part of the market was hit for its geographic proximity to the war and its regional reliance on Russian gas and oil.

- All UK equity sectors fell with the IA UK All Companies sector down 4.9%, and the IA UK Smaller Companies sector returning -13.1%. The IA UK Equity Income sector was by far the best home market equity sector, with a flat return of -0.04% due to the combination of the typical value style for income funds, and a common overweighting of the already large oil and mining sectors in the UK market.

- The recently rejigged IA Bond sectors all lost ground with the least worst of the bunch being IA USD High Yield Bond falling just 1.75%. At the other end of the spectrum, the IA Global Emerging Markets Bond Hard Currency sector lost 7.61%. The equivalent local currency sector lost just 2.65% as resources strength flowed into currency markets too.

- Turning to UK bonds, The IA UK Gilt sector fell a significant 7.29% reflecting the longer duration of our home government bond market these days. The IA Corporate Bond sector benefitted from structurally lower duration falling a comparatively modest 5.57%. Even the IA UK Index Linked Gilt sector fell 6.79%, as duration trumped inflation-linking despite 30-year high inflation prints during the quarter!

- The IA Targeted Absolute Return sector fell -1.8% in the quarter, collectively missing its objective over this short period. The 12-month return for the sector is now a dull 1.6%.

- Looking at the Mixed Asset IA offerings, one might expect a conventional stack with more equity equalling more loss – however the impact of duration meant the sector with the least equity was actually the worst performer; the IA Mixed Investment 0-35% Shares sector fell 3.8%, followed by the sector with the most equity, IA Mixed 40-85% Shares, falling 3.6%, then the IA Mixed Investment 20-60% Shares falling 3.4% for quite a tight range overall reflecting the twin headwinds of equity beta and duration for the quarter.

- The IA Global Equity sector fell 4.8% against a return for the IA Global Equity Income sector of down just 0.97%.

From these chaotic conditions some new performance trends may emerge, and we may continue to see the impact of this quarter on consistency of returns and volatility for some time.

Source: Lipper, 31-Dec-21 to 31-Mar-22, Percentage growth, total return.

Currencies

Currencies were volatile and usually in difficult times the Yen can be a seen as a safe haven – but not this quarter with a -2.4% return vs Sterling. Despite the Continent being arguably more affected by the sentiment of war than the UK, the Euro made a small amount of headway against the pound, but the Chinese Yuan was the winner of the four we track with a dollar-beating +3.36% move to the pound.

The three years that this survey covers have been extraordinary for the real world and this has caused significant gyrations in many financial markets and underlying asset classes.

Risky business

Can you have your cake and eat it? Here we search for funds with good risk characteristics and establish which funds offer the holy grail of low risk and high returns. For this purpose, a longer time-period is required, so we look back over three years to the end of the quarter.

- Measured to the end of Q1 2022, yet again no fund achieved the perfect mix of top of the sector 3-year returns with bottom of the sector 3-year volatility. This mix remains elusive.

- The Royal London Sustainable Leaders Trust again featured as one of the best risk/reward combinations, as did Carmignac Portfolio Patrimoine but LF Ruffer Total Return has the best mix of all with 2nd percentile returns and 98th percentile volatility. The middle ground is becoming a crowded place – to achieve long term excellence patience is a necessity.

These conditions have conspired to see the lowest consistency figures we have ever seen.

Summary

In summary, we believe the performance numbers are – as always – well worth crunching to find trends, provide ideas, layer knowledge on how each fund performs and to generally provoke thought. Of course, the analysis must be taken in context, and the qualitative work must be done to allow for fully informed judgments. We hope you found this review interesting, and if you have any questions, please contact:

Columbia Threadneedle Investments press office

Kelly Prior

Rob Burdett

If you would like further details or would like to discuss why we think these points are of interest, then please do contact us. We have our own observations and opinions on this analysis and would be happy to discuss them if appropriate.