Campaign

Threadneedle UK Property Authorised Investment Fund

Seeking a consistent income from bricks and mortar?

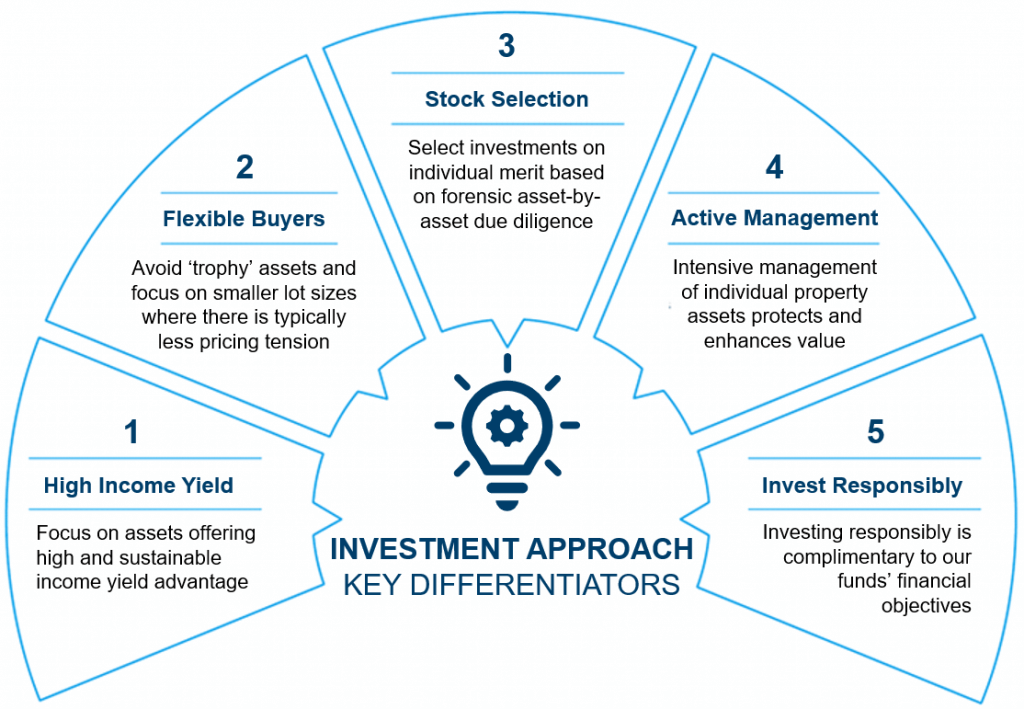

Access commercial property within a daily dealing, well-diversified UK commercial property fund. Adopting an analytical and highly selective investment approach, the Fund seeks assets with sustainable income, derived from numerous tenants, whilst striving to consistently deliver an attractive income yield and strong performance.

*Ratings as at 31.12.2020.

Note: Changes to our property funds’ pricing structure

On 12 April 2019 the Threadneedle UK Property Authorised Investment Fund and the Threadneedle UK Property Authorised Trust changed from being dual priced on a quoted-spread basis to being dual priced on a full-spread basis. Further information can be found below in the property pricing explained document.

Adding value to our Reading retail units

Overview

Major participant in the UK commercial property market

Our Real Estate team is well-resourced and specialised manager of UK commercial property responsible for £8.9 billion in assets.* This facilitates a robust analysis of the leasing and investment markets and a unique strategic perspective.

Focus on income

We target assets where we can add value through active asset management and deliver attractive income yield to our investors.

Excellent long-term performance

We are proud of our consistently strong performance. High transaction volume and lack of legacy issues encourage sellers and their agents to present new investment opportunities to us due to our proven ability to execute.

Driven by high-quality research

Our extensive research helps us gain a perspective advantage, make better decisions, based on smarter insights. We combine external, commissions and in-house analysis to gain a strategic view of the market.

*Source: Columbia Threadneedle Investments Net AUM GBP as at 30.11.2020.

Process

Properties

Source: Columbia Threadneedle Investments as at 31 March 2020.

Insights

UK real estate: offices – finding a new equilibrium

Five stages of managing real estate responsibly

Fund Manager

Gerry Frewin was appointed portfolio manager of the Fund in 2015. He joined Threadneedle Property Investments in 2010 as an investment surveyor. He also assists with transaction activity for the Threadneedle Property Unit Trust, Threadneedle Strategic Property Fund and several third party portfolios.

Contact details

Contact our sales support team

Contact our regional sales team