Campaign

Threadneedle Dynamic Real Return Fund

A consistent, straightforward, long-only and unlevered approach to target return investing

Threadneedle Dynamic Real Return Fund is designed to deliver equity-like returns with up to two-thirds of the volatility by investing in a mix of asset classes and actively adapting the portfolio to changing market conditions. The Fund adopts a consistent, straightforward, long-only and unlevered approach to target return investing.

Overview

Straightforward & transparent

A long only, unlevered fund of funds that can supplement positions with direct holdings and beta strategies

Dynamic asset allocation

Unconstrained approach with no benchmark restrictions and flexibility to take advantage of opportunities as they arise

Volatility controlled

Holistic risk awareness with full look-through into underlying fund holdings

Launch date

18 June 2013

Fund Manager

Toby Nangle

Performance target

Inflation (UK CPI) + 4% gross of fees with up to two-thirds the volatility of global equitites over the medium-long term

Sector

IA Targeted Absolute Return

**Source: Ratings as at 31 December 2020. Performance target may not be attained. Past performance is not a guide to future performance.

Process

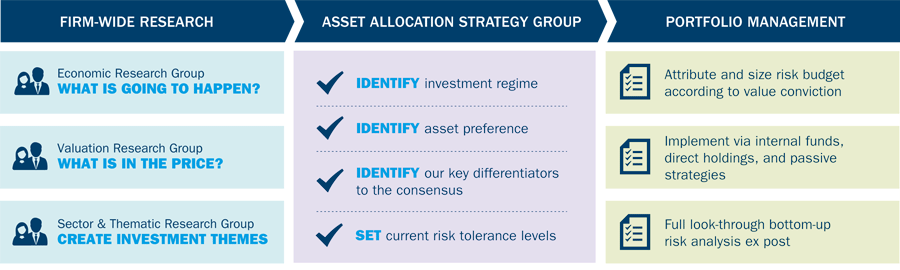

The Fund brings together our two key capabilities: asset allocation and security selection. Drawing on the expertise across the company via various research groups, the team examines economic, valuation and thematic trends to give an all encompassing global perspective. They then seek out areas of differentiation and opportunity, constructing a balanced portfolio implemented through our wide range of internal funds, direct holdings and passive strategies.

Objective

The Fund aims to achieve a higher rate of return from capital appreciation and income than the rate of inflation in the UK (defined as the Consumer Price Index (CPI)), over a period of 3 to 5 years. Currently, the Fund looks to achieve an average annual return of CPI +4% when measured over this same time period, before charges are deducted. The Fund also seeks to deliver a positive return over any 3-year period (net of charges), regardless of market conditions. However, there is a risk to capital, and there is no guarantee that a positive return will be achieved in 3 years, or any other timescale.

The Fund actively manages an exposure to bonds, equities (company shares), money market instruments, cash, currencies, commodities, property and other alternative asset classes on a global basis. The exposure to these asset classes varies over time, as deemed necessary to achieve the investment objective, which may result in the Fund having little or no exposure to certain asset classes.

The Fund obtains exposure to those different asset classes by investing in other collective investment schemes (including funds managed by Columbia Threadneedle companies) or by using derivatives (including forward transactions). The Fund may also invest directly in transferable securities (including bonds and company shares), money market instruments, deposits and cash. The Fund does not invest in physical commodities or directly in real property.

In addition to using derivatives for investment purposes, derivatives may be used with the aim of reducing risk or managing the Fund more efficiently.

Other Information:

Many funds sold in the UK are grouped into sectors by the Investment Association (the trade body that represents UK investment managers), to facilitate comparison between funds with broadly similar characteristics (peer groups). This Fund is currently included in the IA Targeted Absolute Return sector. Performance data on funds within this sector may be used when evaluating the performance of this Fund.

Insights

2021: gotta have faith – in low discount rates

Covid-19 vaccines, lockdowns and equities

Asset Allocation Update - Sep 2020

Filter insights on this page

Capabilities

Media type

Themes

Regions

Fund Manager

Toby Nangle joined the company in 2012 and is currently Head of Multi Asset & Head of Global Asset Allocation, EMEA. In this role he is responsible for managing and co-managing a range of multi-asset portfolios, as well as providing strategic and tactical input to the company’s asset allocation process. Before joining the company, Toby worked at Baring Asset Management, initially in the fixed income team and subsequently as Director of the Multi-Asset Group. He holds degrees in History and International Relations from the University of Cambridge.

Contact details

Contact our sales support team

Contact our regional sales team

Telephone

0207 464 5855*

*Please note calls are recorded

Contact our regional sales team

Find your local sales representative

You may also like

Our Capabilities

We offer a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.

MyThreadneedle

Where your clients can access the value of their investments and access educational materials online, 24 hours a day.