Ecommerce’s influence on total retail sales continues to build with around 16% of US retail sales currently transacted online (excluding autos/gas). Perhaps more importantly, it accounted for over 50% of total growth in 2019.

News of Walmart unveiling its own membership program (which should include same-day grocery delivery) to become an alternative to Amazon Prime should not come as a surprise. In recent years, Amazon has become more aggressive in the grocery segment with its acquisition of Whole Foods, the launch of the Amazon Go grocery convenience stores, and its delivery service.

So what’s special about grocery that makes it the final frontier of eCommerce?

Firstly, grocery lags the other categories with a sub-5% penetration rate and, more importantly, its total addressable market (in other words, its opportunity set) is huge. Total annual retail & food service sales in the US is $6 trillion and annual grocery store sales is circa $700 billion.1 Even a small portion of the market can move the revenue needle for both Amazon and Walmart. Grocery sales already account for over 50% of Walmart’s total US revenue, making it the country’s largest grocer.

Another factor is that Covid-19 has helped to fuel an inflection in digital grocery adoption, so penetration should continue to accelerate.

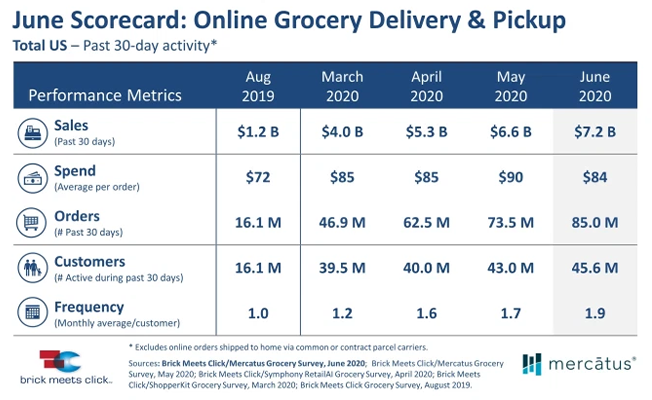

According to the Brick Meets Click/Mercatus Grocery Survey2, approximately 46 million US households used grocery pickup/delivery services in June, up from around 16 million last summer. While not all will stick with it, many surely will (there is a 57% repeat intention), thus paving the way to double-digit digital penetration as soon as 2021. That’s three-plus years sooner than prior industry forecasts. In our global portfolios, we are long-term owners of Amazon and Alibaba, which are both challenging the incumbents in their respective geographies. A reaction to that challenge is to be expected but with food lagging retail in the US to such an extent, there is plenty of room for both to benefit from any rising trend for online food ordering.

Figure 1: US online grocery delivery and pickup (past 30-day activity, at June 2020)