This month we focus on why 2021 could be a turning point for UK pensions and the year in which the UK system

may well be awarded a prestigious B-grade for the first time since 2015…

Will 2021 see the UK pensions system propelled up the global league table?

In Pensions Watch Issue 21 we focused on why the UK pension system was, according to the influential annual

Mercer CFA Institute Global Pension Index Report,2 somewhat in the doldrums. Crucially, we sought to establish

what changes were needed if good retirement outcomes were to become the norm and if the UK was to be

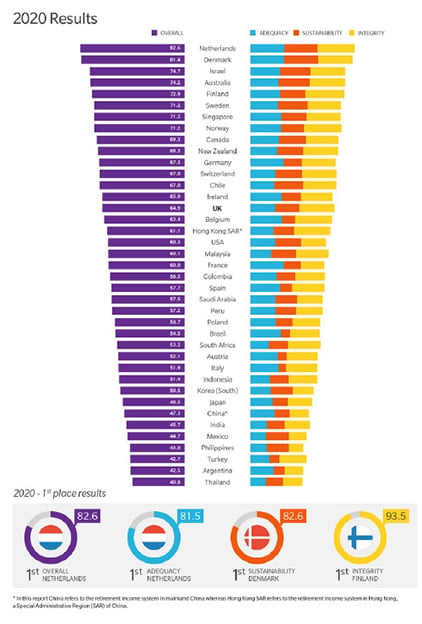

propelled up the global rankings from its lowly and long-standing C+ rating. As shown in Figure 1, although the

Report scored the UK highly for integrity (or, more accurately, security), the UK’s three pillar system fell down on

adequacy and sustainability.

Figure 1: The UK scores highly for integrity but not adequacy and sustainability

Source: Mercer (2020), Mercer CFA Institute Global Pension Index, Mercer, Melbourne. Report Highlights. 2020 Results.

Ideally, adequacy and sustainability should be mutually reinforcing but that isn’t always the case. So let’s take a look

through our own adequacy and sustainability lenses at what 2021 holds for UK pensions, assessing if each measure

is likely to be positive (+), neutral (0) or negative (-), and whether the long awaited turning point is now in sight.

So far, we know that in 2021 the following 10 policy measures will be introduced:

- Courtesy of the triple lock, the state pension will rise by 2.5% in April, far above the rate of wage and price inflation, resulting in an extra £228.80 over the year for those on a full state pension (likely impact: adequacy +, sustainability –).

- The pensions Lifetime Allowance (LTA) will increase from April in line with the CPI index by 0.5% to £1,078,900 (likely impact: adequacy 0, sustainability 0). n From 1 February, advisers, platforms and providers must make the FCA’s four investment pathways available to those entering drawdown on a non-advised basis to support better retirement outcomes (likely impact: adequacy +, sustainability +).

- The long awaited Pension Schemes Bill 2019-213 will become legislation, albeit later in the year:

- introducing Collective Defined Contribution (CDC) schemes, with the first-mover Royal Mail CDC scheme no doubt being keenly observed by many other schemes to see whether the hybrid structure proves to be a success (likely impact: adequacy +, sustainability +);

- extending The Pension Regulator’s (TPR’s) powers and improving its access to information so as to provide yet more protection to pension savers (likely impact: adequacy +, sustainability +);

- …though the Bill will not now introduce an automatic opt-in to Pension Wise, the free and impartial pension guidance service for the over-50s4 (likely impact: adequacy –, sustainability –).

- After a second industry consultation, TPR will, later in the year, be introducing its new and long awaited Defined Benefit (DB) Funding Code – dubbed the biggest revolution for scheme funding and investment requirements in 15 years. (Although the industry has been asked not to make “rash predictions” about its provisions or impact in the interim,5 we say likely impact: adequacy +, sustainability +).

- On 1 October, TPR will introduce more stringent Environmental, Social and Corporate Governance (ESG) and climate risk disclosure requirements.6 With ESG having shot up the agenda in 2020, and momentum likely to build in 2021, this could mark the turning point for UK pension funds tackling ESG risk factors, in particular climate change risk management (likely impact: adequacy +, sustainability +).

- TPR’s regulatory framework for superfunds, or DB consolidators, is due to be released.7 DB consolidation is an area of interest that has gained traction with closed schemes looking for ways to reduce costs and manage liabilities and risks but where buy-out with an insurer is an unobtainable goal in the near term8 (likely impact: adequacy +, sustainability +).

- In an effort to accelerate Defined Contribution (DC) consolidation in a much fragmented market, from October sub-£100m DC schemes will be required to conduct rigorous annual value for member assessments by peer benchmarking their costs and charges, investment returns and various elements of governance and administration. A failure to demonstrate good value will mean providing TPR with a plan to improve or consolidate. The resulting consolidation should see an accelerated transition to fewer and much larger DC funds, thereby reinforcing the trend of single trust-based DC schemes transferring to DC master trusts, given the latter’s economies of scale to cost and governance (likely impact: adequacy +, sustainability +).

- A DWP consultation on amending the 0.75% charge cap to better enable schemes (particularly DC) focused on infrastructure opportunities and other illiquid assets with compelling long-term investment and increasingly ESG characteristics (thereby transforming the green economic recovery), to pay performance fees and exclude the costs of holding illiquids (likely impact: adequacy +, sustainability +).

Given the above, on balance, we’re likely to see big prospective gains in both adequacy and sustainability.

In addition, there are likely to be a number of other policy developments in 2021 that will, again on balance,

reinforce these gains – a prospective move to a flat rate of pensions tax relief being among them.9

So why does all of this matter?

We noted in Pensions Watch Issue 2 that if the UK pension system’s shortcomings, identified in the Mercer CFA

Report, were left unaddressed, the system could very quickly be taken beyond an avoidable tipping point where

sub-par retirement outcomes become the norm. So will these policy measures and developments move us closer

or further away from that tipping point?

Although not directly correlating with the adequacy and sustainability criteria adopted by the Mercer CFA Report,

taken in totality our assessment of these measures will certainly move our pension system away from that cliff

edge and should be sufficient to nudge the system closer, if not to, a B-grade.

However, there is still much to do if the system’s adequacy and sustainability is to be put on a more secure

footing, akin to that of A-graders, the Netherlands and Denmark. Income replacement ratios still lag OECD

averages, stark intergenerational, gender and ethnicity inequalities remain unaddressed, DC contribution levels

still need to rise and easily accessible frames of reference, guidance and advice remain elusive, especially for

those approaching decumulation – to the ultimate detriment of retirement outcomes. That said, with momentum

building around widening auto-enrolment eligibility (resulting in greater inclusion of the disenfranchised and

a narrowing of the pensions gender gap) and with the introduction of the pension dashboard on the horizon

(resulting in greater pension saver engagement), the direction of travel is certainly positive. So while several key

battles will be won in 2021, the war to secure consistently good retirement outcomes and achieve a coveted

A-grade will continue to be fought for some time yet.