The US: Brighter days ahead in a new normal

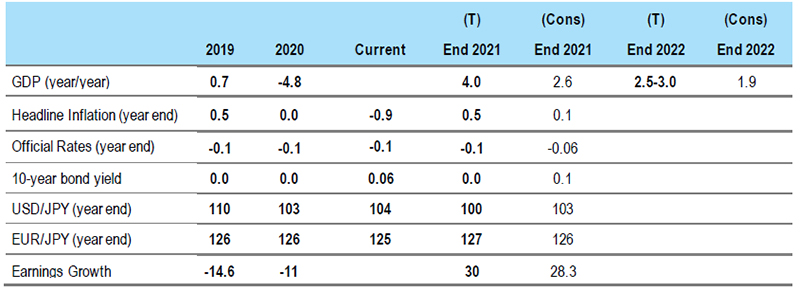

Figure 1: US forecast

Continued support for the economy remains crucial. The Federal Reserve is acutely aware that the pandemic has disproportionately hit low-income, minority households. Chairman Powell has stated his intention to leave rates low for however long it takes to aid the repair. Support packages will be long term. The level of borrowing will reach previously unimaginable levels, further impeding potential growth and, in turn, capping inflation.

Euro Area: Take-off delayed

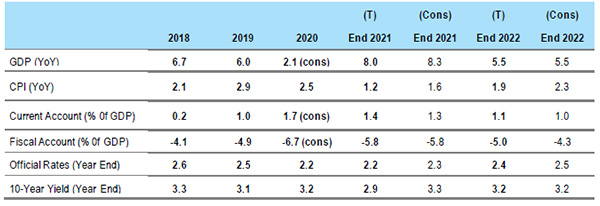

Figure 2: Euro area forecasts

UK: A cyclical boost ahead but structural headwinds await

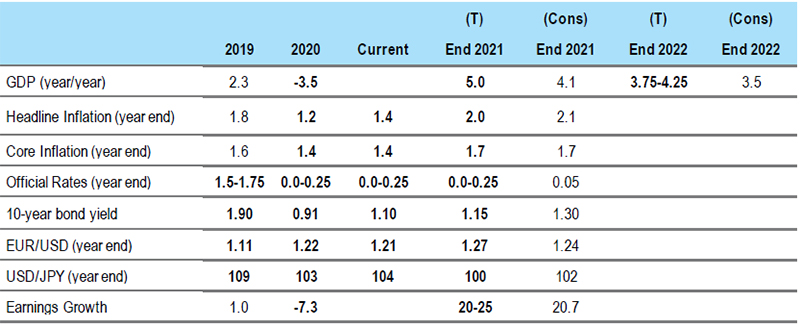

Figure 3: UK forecasts

1. Remote working – The UK ranks second globally, in terms of the proportion of jobs able to be done remotely. We think that a return to pre-pandemic working patterns is unlikely and more remote working is here to stay, to the detriment of office space, city centres and the ancillary services that have been so badly affected.

2. An uneven split of incomes – Savings rates in the UK have gone up, but the data suggests this has come solely from people on higher incomes, who have a lower propensity to consume. Meanwhile, those with earnings less than £55,000 a year have seen savings decline over the course of the pandemic. This indicates a mixed outlook for consumption.

3. Brexit – The EU-UK trade agreement imposes significant non-tariff barriers on exporters and the shipping data we have shows a significant drop in the volume of trade, as well as an extremely large increase in the number of empty lorries returning to the continent. A hit to net exports in 2021 seems likely.

4. Migration – 2020 was a record year for redundancies, yet the official unemployment rate moved only marginally higher, indicating a large drop in the labour force. It has been suggested that as many as 1.3m non-UK nationals may have left the UK, many of whom may find it hard to return under the post-Brexit immigration regime.

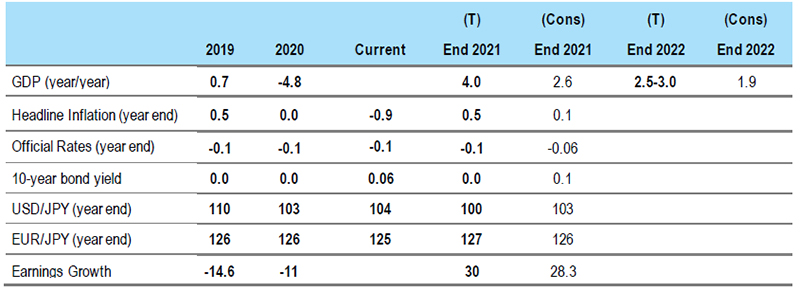

Japan: Heading into a second domestic dip

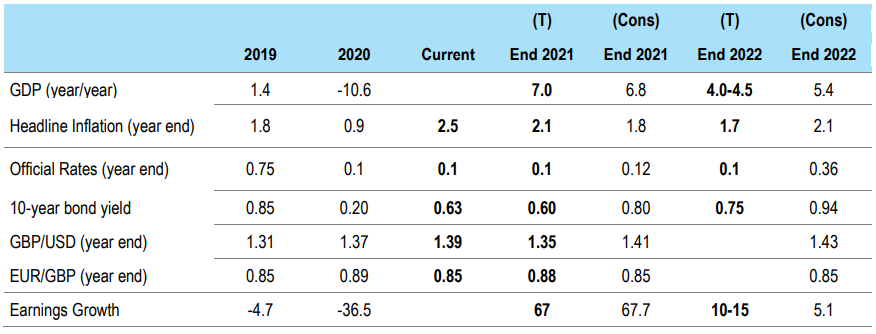

Figure 4: Japan forecasts

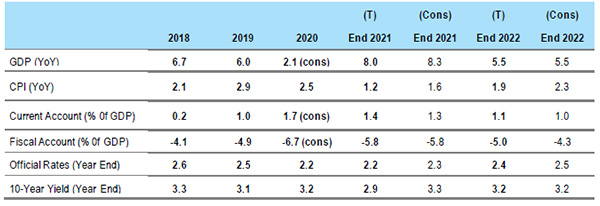

China: No sharp shifts in either direction in monetary policy

Figure 5: China forecasts

Emerging markets: Vaccine access/rollout, the differentiating factor

Figure 6: EM forecasts