The coronavirus continues to introduce uncertainty, but investors should expect cyclicals to outperform

in the first half of the year. Here we identify key catalysts for equity markets.

Covid-19 will continue to impact the economy and markets

We entered 2021 with the prospect of new vaccines taming

Covid-19 and that effort proved transformative in developed

markets. The coronavirus persists, however, and its impact

will continue to be felt in 2022 as the pandemic plays out.

New therapies to prevent serious illness are very promising,

but expect a focus on Covid and a return to normal life to

continue in 2022.

Gauging a company’s exposure to lingering Covid impacts –

and lasting Covid changes – will be an important component

of research in 2022. Another important Covid carry over is

that we expect cyclicals to outperform in the first half of the

year, especially given expected ongoing economic reopening

and above-average GDP growth.

Supply chain disruptions will start to improve – eventually

The pandemic was the proximate cause of supply chain disruption,

shuttering manufacturing facilities globally. For industries with “just-intime”

inventory practices this was extremely challenging, as replenishing

exhausted inventories proved nearly impossible, or at the very least very

expensive. We expect elements of the supply chain to improve over the

course of 2022, but there is still a significant backlog and wide variation

among companies in their access to materials and success in passing

costs on to consumers.

The seized gears of the supply chain caused many to speculate that

the world would move manufacturing away from China or even onshore

production. But the considerable cap ex required to drive that radical

change seems unlikely. What is likely to change, however, is how much

inventory companies decide to hold, and that means that focusing on

inventory levels and pricing power as part of fundamental research takes

on heightened importance. There will be clear winners and losers in this

environment, and active positioning will set investors up for success,

especially in the context of cyclical opportunities in the first half of the year.

Higher rates, lower valuations?

Historically, higher interest rates have correlated with lower equity

valuations. Higher rates in 2022 could put equity multiples under pressure,

which means it is important to know what you are paying for. For investors

whose value exposure is below their strategic allocation, 2022 could be a

good environment to increase that allocation. That said, cheap is not an

investment thesis; in an environment of greater dispersion, understanding

the fundamentals of a company relative to the price is essential.

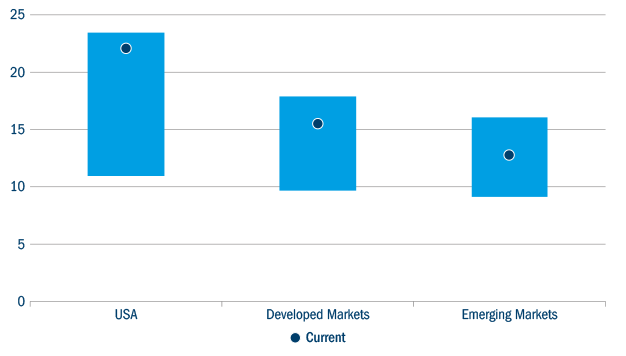

Investing in the US versus elsewhere

Equities are expensive in most regions, but on a relative basis valuation

metrics are more attractive in Europe and emerging markets (EMs) than

the US (Figure 1). Headlines around China and inflationary pressures may

cause some anxiety regarding EMs, but a strategic allocation still makes

sense as long as it fits your risk tolerance.

Figure 1: Global equity valuations – few places to hide

Source: Columbia Threadneedle based on IBES estimates. Charts show global P/Es high/low/current from 10/2011-

10/2021. P/E is calculated using the following indices: US, MSCI USA Index, designed to measure the performance of the

large and mid-cap segments of the US market. Developed markets: MSCI Europe, Australasia, Far East (EAFE) Index is a

capitalisation-weighted index that tracks the total return of common stocks in 21 developed-market countries. Emerging

Markets: MSCI Emerging Markets Index (EMI) is a free float-adjusted market capitalisation index designed to measure equity

market performance in the global emerging markets. It is not possible to invest directly in an index.

Real capital is flowing to responsible investment

Investor interest in responsible investment has been rising over the past

few years, and this should accelerate in 2022. Environmental challenges

such as a warmer climate, limited water or wildfires each pose risks

to companies, and thinking about those risks as you conduct your

fundamental research is a way of protecting your portfolio.

A bumpy ride higher

I expect headline risk in 2022, especially around inflation, interest rates

and energy prices. I don’t see a catalyst for a big equity swoon, but

that doesn’t necessarily mean we get to a place that is higher than the

beginning of the year smoothly. I expect greater dispersion among winners

and losers because of the stresses of supply chains, inflation and the

cost of doing business, and higher rates. Investors need to be selective

about what they own. The highest growth stocks are likely to be subject to

greater volatility as interest rates rise.